Instructions For Rpd-41096 - An Application For Extension Of Time To File - New Mexico Taxation And Revenue Department

ADVERTISEMENT

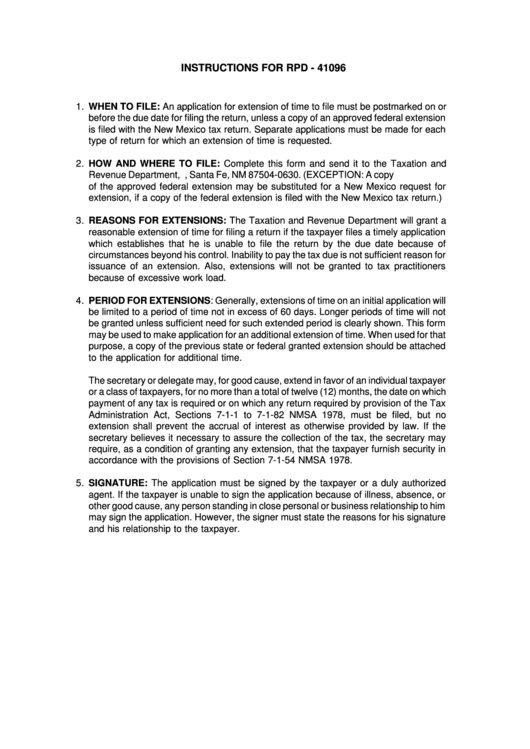

INSTRUCTIONS FOR RPD - 41096

1.

WHEN TO FILE: An application for extension of time to file must be postmarked on or

before the due date for filing the return, unless a copy of an approved federal extension

is filed with the New Mexico tax return. Separate applications must be made for each

type of return for which an extension of time is requested.

2.

HOW AND WHERE TO FILE: Complete this form and send it to the Taxation and

Revenue Department, P.O. Box 630, Santa Fe, NM 87504-0630. (EXCEPTION: A copy

of the approved federal extension may be substituted for a New Mexico request for

extension, if a copy of the federal extension is filed with the New Mexico tax return.)

3.

REASONS FOR EXTENSIONS: The Taxation and Revenue Department will grant a

reasonable extension of time for filing a return if the taxpayer files a timely application

which establishes that he is unable to file the return by the due date because of

circumstances beyond his control. Inability to pay the tax due is not sufficient reason for

issuance of an extension. Also, extensions will not be granted to tax practitioners

because of excessive work load.

4.

PERIOD FOR EXTENSIONS: Generally, extensions of time on an initial application will

be limited to a period of time not in excess of 60 days. Longer periods of time will not

be granted unless sufficient need for such extended period is clearly shown. This form

may be used to make application for an additional extension of time. When used for that

purpose, a copy of the previous state or federal granted extension should be attached

to the application for additional time.

The secretary or delegate may, for good cause, extend in favor of an individual taxpayer

or a class of taxpayers, for no more than a total of twelve (12) months, the date on which

payment of any tax is required or on which any return required by provision of the Tax

Administration Act, Sections 7-1-1 to 7-1-82 NMSA 1978, must be filed, but no

extension shall prevent the accrual of interest as otherwise provided by law. If the

secretary believes it necessary to assure the collection of the tax, the secretary may

require, as a condition of granting any extension, that the taxpayer furnish security in

accordance with the provisions of Section 7-1-54 NMSA 1978.

5.

SIGNATURE: The application must be signed by the taxpayer or a duly authorized

agent. If the taxpayer is unable to sign the application because of illness, absence, or

other good cause, any person standing in close personal or business relationship to him

may sign the application. However, the signer must state the reasons for his signature

and his relationship to the taxpayer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1