Model Domestic Relations Order - The Teachers' And State Employees' Retirement System Page 2

ADVERTISEMENT

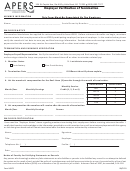

M

D

R

O

ODEL

OMESTIC

ELATIONS

RDER

The Teachers’ and State Employees’ Retirement System

His/Her last known address is ______________________________. His/Her date of birth is

_____.

4.

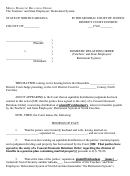

This Order recognizes plaintiff’s/defendant’s (hereinafter “the non-member ex-

spouse”) marital interest in the benefits payable by the Retirement System to plaintiff/

defendant (hereinafter “the member”). The marital interest of the non-member ex-spouse in the

member's benefits payable by the Retirement System shall be calculated as follows: fifty per cent

(50%) [or _____ per cent (____ %)] of the amount determined by multiplying the member’s

total benefit by a fraction, the numerator of which shall be the total months of creditable service

earned during the marriage, including creditable service purchased during the marriage, and the

denominator of which shall be the member’s total number of months of creditable service at the

time of retirement or of a withdrawal of accumulated contributions.

OR

4.

This Order recognizes plaintiff’s/defendant’s (hereinafter the non-member ex-

spouse) marital interest in the benefits payable by the Retirement System to plaintiff/ defendant

(hereinafter the member). The marital interest of the non-member ex-spouse in the member’s

benefits payable by the Retirement System shall be calculated as follows: fifty per cent (50%)

[or _____ per cent (____ %)] of the member’s benefit, commencing as of the member’s actual

retirement date, calculated by utilizing the member’s average final compensation as of the date of

separation, years of creditable service standing to his/her credit as of the date of separation, and

the statutory accrual rate as of the date of retirement, unreduced by any reduction factor which

may be applied for early retirement [or, reduced by the same percentage as is actually applied

to the member’s benefit for early retirement, if any].

5.

The formula set forth in Finding of Fact 4 shall be applied to all retirement

benefits payable to the member or to his/her designated survivor(s) under any option contained

in G.S. 135-5(g). Should a return of contributions become payable pursuant to G.S. 135-5(f), the

non-member ex-spouse shall be paid 50% [or ____ %] of the member’s accumulated

contributions as of the date of separation. Should a post-retirement return of accumulated

contributions become payable pursuant to G.S. 135-5(g1) then the non-member ex-spouse shall

be paid 50% [or ____ %] of the balance of the member’s accumulated contributions at his/her

death, plus accrued interest payable as applicable.

6.

The formula set forth in Finding of Fact 4 shall/shall not apply to any Special

Retirement Allowance which may become payable pursuant to G.S. 135-5(m1) or (m2) by virtue

of a transfer of funds from the member’s account with the Supplemental Retirement Income Plan

(NC 401(k) Plan) or the Public Employee Deferred Compensation Plan (NC 457 Plan).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4