Form 90-145-10-8-1-000 - Mississippi Prepaid Wireless E911 Charge

ADVERTISEMENT

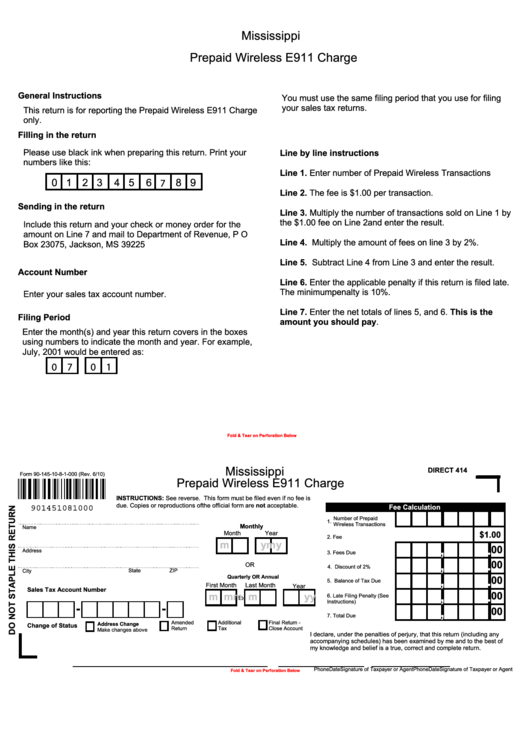

Mississippi

Prepaid Wireless E911 Charge

General Instructions

You must use the same filing period that you use for filing

your sales tax returns.

This return is for reporting the Prepaid Wireless E911 Charge

only.

Filling in the return

Please use black ink when preparing this return. Print your

Line by line instructions

numbers like this:

Line 1. Enter number of Prepaid Wireless Transactions

0 1

2 3

4 5

6

8 9

7

Line 2. The fee is $1.00 per transaction.

Sending in the return

Line 3. Multiply the number of transactions sold on Line 1 by

the $1.00 fee on Line 2 and enter the result.

Include this return and your check or money order for the

amount on Line 7 and mail to Department of Revenue, P O

Line 4. Multiply the amount of fees on line 3 by 2%.

Box 23075, Jackson, MS 39225

Line 5. Subtract Line 4 from Line 3 and enter the result.

Account Number

Line 6. Enter the applicable penalty if this return is filed late.

The minimum penalty is 10%.

Enter your sales tax account number.

Line 7. Enter the net totals of lines 5, and 6. This is the

Filing Period

amount you should pay.

Enter the month(s) and year this return covers in the boxes

using numbers to indicate the month and year. For example,

July, 2001 would be entered as:

0

7

0

1

Fold & Tear on Perforation Below

Mississippi

DIRECT 414

Form 90-145-10-8-1-000 (Rev. 6/10)

Prepaid Wireless E911 Charge

INSTRUCTIONS: See reverse. This form must be filed even if no fee is

due. Copies or reproductions of the official form are not acceptable.

Fee Calculation

901451081000

Number of Prepaid

1.

Wireless Transactions

Monthly

Name

$1.00

Month

Year

2. Fee .......................................................................................

,

.

m

m

y

y

00

Address

3. Fees Due

,

.

00

OR

4. Discount of 2%

,

.

ZIP

City

State

Quarterly OR Annual

00

5. Balance of Tax Due

,

.

First Month

Last Month

Year

Sales Tax Account Number

00

m m

m m

y

y

6. Late Filing Penalty (See

to

.

,

Instructions)

-

-

00

7. Total Due

Amended

Additional

Final Return -

Address Change

Change of Status

Return

Tax

Close Account

Make changes above

I declare, under the penalties of perjury, that this return (including any

accompanying schedules) has been examined by me and to the best of

my knowledge and belief is a true, correct and complete return.

Signature of Taxpayer or Agent

Signature of Taxpayer or Agent

Phone

Phone

Date

Date

Fold & Tear on Perforation Below

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1