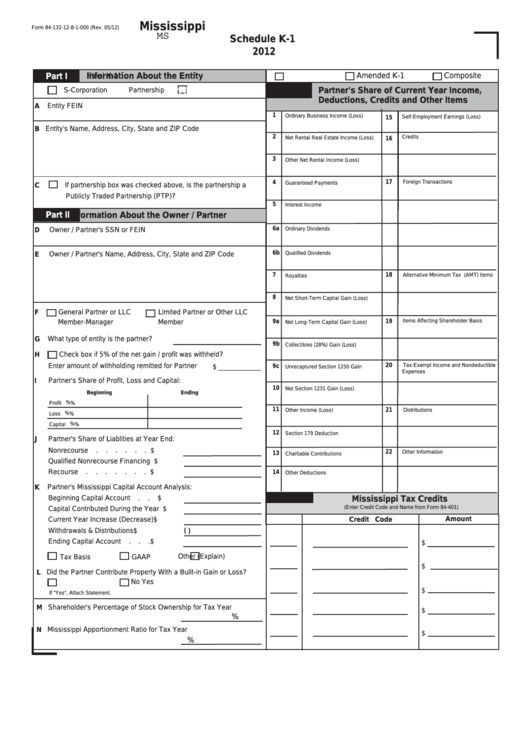

Mississippi

Form 84-132-12-8-1-000 (Rev. 05/12)

MS

Schedule K-1

2012

Information About the Entity

Amended K-1

Composite

Part I

Final K-1

Part III

Partner's Share of Current Year Income,

S-Corporation

Partnership

Deductions, Credits and Other Items

Entity FEIN

A

1

Ordinary Business Income (Loss)

Self-Employment Earnings (Loss)

15

B Entity's Name, Address, City, State and ZIP Code

2

Credits

Net Rental Real Estate Income (Loss)

16

3

Other Net Rental Income (Loss)

17

4

Foreign Transactions

Guaranteed Payments

C

If partnership box was checked above, is the partnership a

Publicly Traded Partnership (PTP)?

5

Interest Income

Part II

Information About the Owner / Partner

6a

Ordinary Dividends

D

Owner / Partner's SSN or FEIN

6b

Qualified Dividends

E

Owner / Partner's Name, Address, City, State and ZIP Code

7

18

Alternative Minimum Tax (AMT) Items

Royalties

8

Net Short-Term Captial Gain (Loss)

F

General Partner or LLC

Limited Partner or Other LLC

9a

19

Items Affecting Shareholder Basis

Member-Manager

Member

Net Long-Term Capital Gain (Loss)

What type of entity is the partner?

G

9b

Collectibles (28%) Gain (Loss)

H

Check box if 5% of the net gain / profit was withheld?

Enter amount of withholding remitted for Partner

20

Tax-Exempt Income and Nondeductible

9c

$ ___________

Unrecaptured Section 1250 Gain

Expenses

I

Partner's Share of Profit, Loss and Capital:

10

Net Section 1231 Gain (Loss)

Beginning

Ending

%

Profit

%

11

21

Distributions

Other Income (Loss)

%

Loss

%

%

%

Capital

12

Section 179 Deduction

J

Partner's Share of Liablities at Year End:

Nonrecourse

.

.

.

.

.

.

$

22

Other Information

13

Charitable Contributions

Qualified Nonrecourse Financing

$

Recourse

.

.

.

.

.

.

.

$

14

Other Deductions

K

Partner's Mississippi Capital Account Analysis:

Part IV

Beginning Capital Account

.

.

$

Mississippi Tax Credits

(Enter Credit Code and Name from Form 84-401)

Capital Contributed During the Year

$

Amount

Current Year Increase (Decrease)

$

Code

Credit

Withdrawals & Distributions

$

(

)

Ending Capital Account

.

.

.

$

$

Other (Explain)

Tax Basis

GAAP

$

L Did the Partner Contribute Property With a Bulit-in Gain or Loss?

Yes

No

$

If "Yes", Attach Statement.

M Shareholder's Percentage of Stock Ownership for Tax Year

$

%

N Mississippi Apportionment Ratio for Tax Year

$

%

1

1