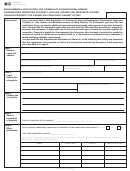

P r o p e r t y T a x

Application For Constructing or Rehabilitating Low-Income Housing Property Tax Exemption

Form 50-310

STEP 3: Provide Name and Mailing Address of Property Owner and Identity of Person Preparing Application (continued)

If this application is for an exemption from ad valorem taxation of property owned by a charitable

organization with a federal tax identification number, that number may be provided here in lieu of

____________________________

a driver’s license number, personal identification certificate number, or social security number: . . . . . . . . . . .

* Unless the applicant is a charitable organization with a federal tax identification number, the applicant’s driver’s license number, personal identification certificate number,

or social security account number is required. Pursuant to Tax Code Section 11.48(a), a driver’s license number, personal identification certificate number, or social security

account number provided in an application for an exemption filed with a chief appraiser is confidential and not open to public inspection. The information may not be disclosed

to anyone other than an employee of the appraisal office who appraises property, except as authorized by Tax Code Section 11.48(b). If the applicant is a charitable organization

with a federal tax identification number, the applicant may provide the organization’s federal tax identification number in lieu of a driver’s license number, personal identification

certificate number, or social security account number.

STEP 4: Identify the Property

1. Provide the property’s legal description.

____________________________

2. What is the appraisal district account number (if known)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

____________________________________________________________________________

3. What is the property address?

Street

____________________________________________________________________________

City, State, ZIP Code

STEP 5: Identify Qualifying Organization

To receive an exemption under Tax Code §11.1825, either the property owner or one of two other entities must meet the requirements set forth in Tax Code

§11.1825(b).

Pursuant to Tax Code §11.1825(c), property may qualify for an exemption under Tax Code §11.1825 if the property owner does not meet the requirements of

Tax Code §11.1825(b) if the property otherwise qualifies for the exemption and the owner is:

(1) a limited partnership of which an organization that meets the requirements of Tax Code §11.1825(b) controls 100 percent of the general partner

interest, is organized under the laws of Texas, and has its principal place of business in Texas; or

(2) an entity the parent of which is an organization that meets the requirements of Tax Code §11.1825(b), is organized under the laws of Texas, and has

its principal place of business in Texas.

For purposes of this application, the term “qualifying organization” refers to the organization (property owner or other entity described by Tax

Code §11.1825(c)) that meets the Tax Code §11.1825(b) requirements:

(1) for at least the preceding three years, the organization:

(A) has been exempt from federal income taxation under Section 501(a), Internal Revenue Code of 1986, as amended, by being listed as an exempt

entity under Section 501(c)(3) of that code;

(B) has met the requirements of a charitable organization provided by Tax Code §11.18(e) and (f); and

(C) has had as one of its purposes providing low-income housing;

(2) a majority of the members of the board of directors of the organization have their principal place of residence in this state;

(3) at least two of the positions on the board of directors of the organization must be reserved for and held by:

(A) an individual of low income as defined by Section 2306.004, Government Code, whose principal place of residence is located in this state;

(B) an individual whose residence is located in an economically disadvantaged census tract as defined by Section 783.009(b), Government Code,

in this state; or

(C) a representative appointed by a neighborhood organization in this state that represents low-income households; and

(4) the organization must have a formal policy containing procedures for giving notice to and receiving advice from low-income households residing in the

county in which a housing project is located regarding the design, siting, development, and management of affordable housing projects.

Does the property owner identified in Step 3, above, meet the requirements of Tax Code §11.1825(b)?

. . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Note: If you answered “yes,” the property owner is the qualifying organization for purposes of the remainder of this application and you may skip

to Step 6. If you answered “no,” the property owner is not the qualifying organization for purposes of the remainder of this application and you

must provide the following information before proceeding to Step 6.

For more information, visit our website:

Page 2 • 50-310 • 09-12/7

1

1 2

2 3

3 4

4 5

5