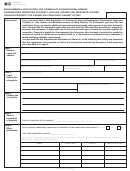

P r o p e r t y T a x

Application For Constructing or Rehabilitating Low-Income Housing Property Tax Exemption

Form 50-310

STEP 5: Identify Qualifying Organization (continued)

If the property owner identified in Step 3, above, does not meet the requirements of Tax Code §11.1825(b), please identify the qualifying organization

pursuant to Tax Code §11.1825(c):

___________________________________________________________________________________________________

Name of Qualifying Organization

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________________

____________________

City, State, ZIP Code

Phone (area code and number)

Is the qualifying organization identified above organized under the laws of Texas? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Does the qualifying organization identified above have its principal place of business in Texas? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Pursuant to Tax Code §11.1825(c)(1), is the property owner a limited partnership of which the qualifying organization

identified above controls 100 percent of the general partner interest? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, please attach organizational documents supporting your answer.

Pursuant to Tax Code §11.1825(c)(2), is the qualifying organization the parent of the property owner? . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, please attach organizational documents supporting your answer.

STEP 6: Provide Information Regarding Qualifying Organization (identified in Step 5)

1. Is the organization engaged primarily in public charitable functions? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, using an attachment, describe the organization’s activities in a narrative. The narrative description of activities should be

thorough, accurate and include date-specific references to the tax year for which the exemption is sought. You may also attach

representative copies of newsletters, brochures or similar documents for supporting details to this narrative.

2. Is the organization organized exclusively to perform religious, charitable, scientific, literary or educational purposes? . . . . . . . . .

Yes

No

If yes, attach copies of organizational documents supporting your answer.

STEP 7: Answer the Following Questions About the Organization

For the preceding three years (note years) ___________________, answer these questions:

1. Has the organization been exempt from federal income taxation under Section 501(a), Internal Revenue Code of 1986,

as amended, as an exempt entity under Section 501(c)(3) of that Code? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

2. Has the organization operated, or its charter permit to operate, in a manner that permits the accrual of profits or distribution

of any form of private gain? If yes, explain on a separate attached page. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

3. Has the organization used its assets in providing low-income housing? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

4. In the past year has the organization loaned funds to, borrowed funds from, sold property to or bought property from a shareholder,

director or member of the organization, or has a shareholder or member sold his interest in the organization for a profit? . . . . .

Yes

No

If “Yes,” attach a description of each transaction. For sales, give buyer, seller, price paid, value of the property sold and

date of sale. For loans, give lender, borrower, amount borrowed, interest rate and term of loan. Attach a copy of note, if any.

5. Attach a list of salaries and other compensation for services paid in the last year. List any funds distributed to members,

shareholders or directors in the last year. In each case, give recipient’s name, type of service rendered or reason for

payment and amounts paid.

About the board of directors, answer these questions:

1. Does a majority of the members of the organization’s board of directors of the organization have their principal place of

residence in Texas? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Attach a list of the board members and their principal places of residence.

2. Do two or more directors on the board whose principal place of residence is located in Texas meet one of the following

requirements: an individual of low income as defined by Section 2306.004, Government Code; or an individual whose

residence is located in an economically disadvantaged census tract in Texas, as defined by Section 783.009(b), Government

Code; or is a representative appointed by a neighborhood organization in Texas that represents low-income households? . . . .

Yes

No

Note on attached list of board members those directors that meet one of these provisions, and indicate which provisions.

For more information, visit our website:

50-310 • 09-12/7 • Page 3

1

1 2

2 3

3 4

4 5

5