P r o p e r t y T a x

Application For Constructing or Rehabilitating Low-Income Housing Property Tax Exemption

Form 50-310

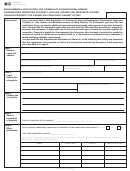

STEP 9: Provide Information Regarding Audit

Pursuant to Tax Code §11.1826, property may not be exempted under Tax Code §11.1825 for a tax year unless the organization owning or controlling the

owner of the property has an audit prepared by an independent auditor covering the organization’s most recent fiscal year.

The audit must include an opinion on whether:

(1) the financial statements of the organization present fairly, in all material respects and in conformity with generally accepted accounting principles, the

financial position, changes in net assets, and cash flows of the organization; and

(2) the organization has complied with all of the terms and conditions of the exemption under Tax Code §11.1825.

Not later than the 180th day after the last day of the organization’s most recent fiscal year, the organization must deliver a copy of the audit to the Texas

Department of Housing and Community Affairs and the chief appraiser of the appraisal district in which the property is located.

If the property contains not more than 36 dwelling units, the organization may deliver to the Texas Department of Housing and Community Affairs and the

chief appraiser a detailed report and certification as an alternative to an audit.

1. Did the organization timely deliver the required audit or report and certification, as applicable, to the Texas Department

of Housing and Community Affairs? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If no, attach a statement explaining your answer.

2. Did the organization timely deliver the required audit or report and certification, as applicable, to the appraisal district? . . . . . . . .

Yes

No

If no, attach a statement explaining your answer.

STEP 10: Provide Property Specific Information

If the property is under construction or rehabilitation:

• Attach a Schedule A (CONSTRUCTING) form for each parcel of land and each building of real property to be exempt for constructing low-income housing.

• Attach a Schedule B (REHABILITATING) form for each parcel of land and building to be exempt for rehabilitating low-income housing.

If the property’s construction or rehabilitation is complete and this application is filed annually as required by Tax Code Section 11.43(b) to maintain a previously

granted exemption, skip to Step 11.

STEP 11: Read, Sign, and Date

By signing this application, you certify that the information provided is true and correct to the best of your knowledge and belief.

___________________________________________________________________________________________________

On Behalf of (name of property owner)

__________________________________________________________

______________________________________

Authorized Signature

Date

__________________________________________________________

______________________________________

Printed Name of Person Authorized to File Application

Title

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal

Code.

For more information, visit our website:

50-310 • 09-12/7 • Page 5

1

1 2

2 3

3 4

4 5

5