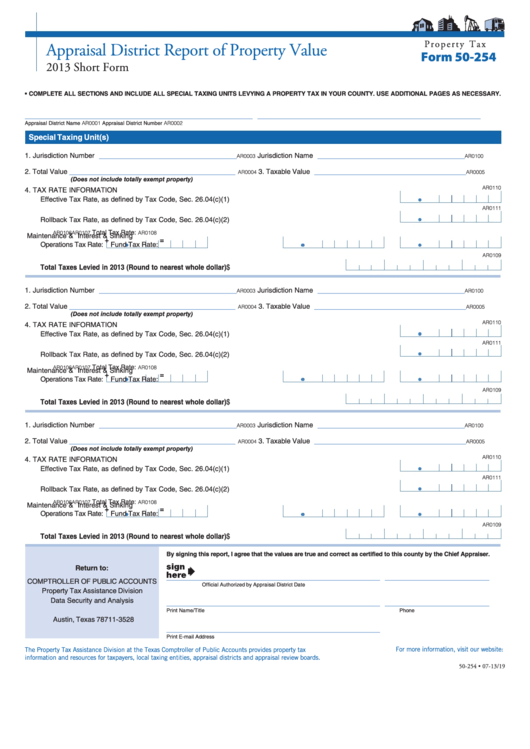

P r o p e r t y T a x

Appraisal District Report of Property Value

Form 50-254

2013 Short Form

• COMPLETE ALL SECTIONS AND INCLUDE ALL SPECIAL TAXING UNITS LEVYING A PROPERTY TAX IN YOUR COUNTY. USE ADDITIONAL PAGES AS NECESSARY.

________________________________________________

_______________________________________________

Appraisal District Name

AR0001

Appraisal District Number

AR0002

Special Taxing Unit(s)

_____________________________

_______________________________

1. Jurisdiction Number

Jurisdiction Name

AR0003

AR0100

___________________________________

________________________________

2. Total Value

3. Taxable Value

AR0004

AR0005

(Does not include totally exempt property)

AR0110

4. TAX RATE INFORMATION

Effective Tax Rate, as defined by Tax Code, Sec. 26.04(c)(1)........................................................................................

AR0111

Rollback Tax Rate, as defined by Tax Code, Sec. 26.04(c)(2) .......................................................................................

Total Tax Rate:

AR0106

AR0107

AR0108

Maintenance &

Interest & Sinking

+

=

Operations Tax Rate:

Fund Tax Rate:

AR0109

Total Taxes Levied in 2013 (Round to nearest whole dollar) ............................................................. $

_____________________________

_______________________________

1. Jurisdiction Number

Jurisdiction Name

AR0003

AR0100

___________________________________

________________________________

2. Total Value

3. Taxable Value

AR0004

AR0005

(Does not include totally exempt property)

AR0110

4. TAX RATE INFORMATION

Effective Tax Rate, as defined by Tax Code, Sec. 26.04(c)(1)........................................................................................

AR0111

Rollback Tax Rate, as defined by Tax Code, Sec. 26.04(c)(2) .......................................................................................

Total Tax Rate:

AR0106

AR0107

AR0108

Maintenance &

Interest & Sinking

+

=

Operations Tax Rate:

Fund Tax Rate:

AR0109

Total Taxes Levied in 2013 (Round to nearest whole dollar) ............................................................. $

_____________________________

_______________________________

1. Jurisdiction Number

Jurisdiction Name

AR0003

AR0100

___________________________________

________________________________

2. Total Value

3. Taxable Value

AR0004

AR0005

(Does not include totally exempt property)

AR0110

4. TAX RATE INFORMATION

Effective Tax Rate, as defined by Tax Code, Sec. 26.04(c)(1)........................................................................................

AR0111

Rollback Tax Rate, as defined by Tax Code, Sec. 26.04(c)(2) .......................................................................................

Total Tax Rate:

AR0106

AR0107

AR0108

Maintenance &

Interest & Sinking

+

=

Operations Tax Rate:

Fund Tax Rate:

AR0109

Total Taxes Levied in 2013 (Round to nearest whole dollar) ............................................................. $

By signing this report, I agree that the values are true and correct as certified to this county by the Chief Appraiser.

Return to:

_____________________________________________

______________________

COMPTROLLER OF PUBLIC ACCOUNTS

Official Authorized by Appraisal District

Date

Property Tax Assistance Division

Data Security and Analysis

_____________________________________________

______________________

P.O. Box 13528

Print Name/Title

Phone (area code and number)

Austin, Texas 78711-3528

_____________________________________________

Print E-mail Address

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-254 • 07-13/19

1

1 2

2