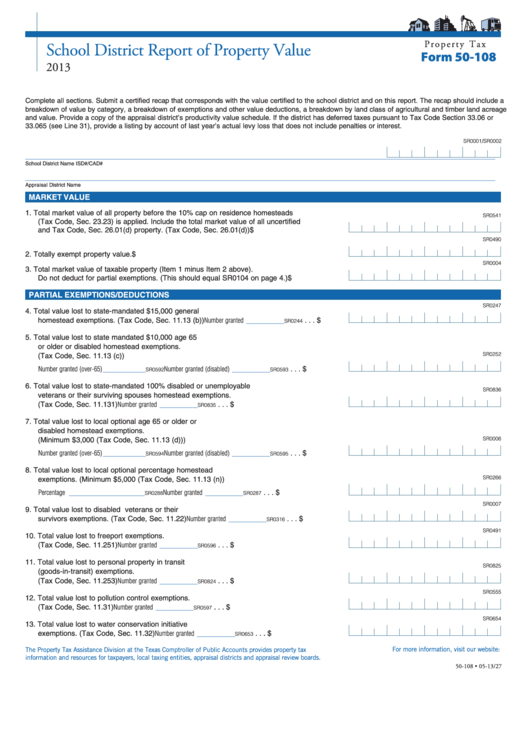

P r o p e r t y T a x

School District Report of Property Value

Form 50-108

2013

Complete all sections. Submit a certified recap that corresponds with the value certified to the school district and on this report. The recap should include a

breakdown of value by category, a breakdown of exemptions and other value deductions, a breakdown by land class of agricultural and timber land acreage

and value. Provide a copy of the appraisal district’s productivity value schedule. If the district has deferred taxes pursuant to Tax Code Section 33.06 or

33.065 (see Line 31), provide a listing by account of last year’s actual levy loss that does not include penalties or interest.

SR0001/SR0002

___________________________________________________________________________________________________

School District Name

ISD#/CAD#

___________________________________________________________________________________________________

Appraisal District Name

MARKET VALUE

1.

Total market value of all property before the 10% cap on residence homesteads

SR0541

(Tax Code, Sec. 23.23) is applied. Include the total market value of all uncertified

and Tax Code, Sec. 26.01(d) property. (Tax Code, Sec. 26.01(d)) . . . . . . . . . . . . . . . . . . . . . . $

SR0490

2. Totally exempt property value. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

SR0004

3. Total market value of taxable property (Item 1 minus Item 2 above).

Do not deduct for partial exemptions. (This should equal SR0104 on page 4.). . . . . . . . . . . . $

PARTIAL EXEMPTIONS/DEDUCTIONS

SR0247

4. Total value lost to state-mandated $15,000 general

________

homestead exemptions. (Tax Code, Sec. 11.13 (b)) . . . . .

Number granted

. . . $

SR0244

5. Total value lost to state mandated $10,000 age 65

or older or disabled homestead exemptions.

SR0252

(Tax Code, Sec. 11.13 (c))

_________

________

Number granted (over-65)

. . . . . . .

Number granted (disabled)

. . . $

SR0592

SR0593

6. Total value lost to state-mandated 100% disabled or unemployable

SR0836

veterans or their surviving spouses homestead exemptions.

________

(Tax Code, Sec. 11.131) . . . . . . . . . . . . . . . . . . . . . . . . . .

Number granted

. . . $

SR0835

7.

Total value lost to local optional age 65 or older or

disabled homestead exemptions.

SR0006

(Minimum $3,000 (Tax Code, Sec. 11.13 (d)))

_________

________

Number granted (over-65)

. . . . . . .

Number granted (disabled)

. . . $

SR0594

SR0595

8. Total value lost to local optional percentage homestead

SR0266

exemptions. (Minimum $5,000 (Tax Code, Sec. 11.13 (n))

________________

________

Percentage

. . . . . . . . . . . . .

Number granted

. . . $

SR0288

SR0287

SR0007

9. Total value lost to disabled veterans or their

________

survivors exemptions. (Tax Code, Sec. 11.22) . . . . . . . . .

Number granted

. . . $

SR0316

SR0491

10. Total value lost to freeport exemptions.

________

(Tax Code, Sec. 11.251) . . . . . . . . . . . . . . . . . . . . . . . . . .

Number granted

. . . $

SR0596

11. Total value lost to personal property in transit

SR0825

(goods-in-transit) exemptions.

________

(Tax Code, Sec. 11.253) . . . . . . . . . . . . . . . . . . . . . . . . . .

Number granted

. . . $

SR0824

SR0555

12. Total value lost to pollution control exemptions.

________

(Tax Code, Sec. 11.31) . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number granted

. . . $

SR0597

SR0654

13. Total value lost to water conservation initiative

________

exemptions. (Tax Code, Sec. 11.32) . . . . . . . . . . . . . . . . .

Number granted

. . . $

SR0653

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-108 • 05-13/27

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9