Form 50-254 - 2008 Appraisal District Report Of Property Value Short Form

ADVERTISEMENT

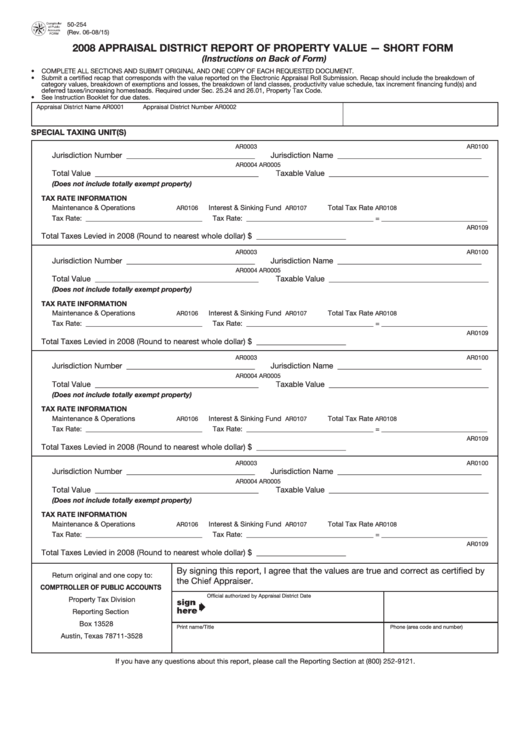

50-254

(Rev. 06-08/15)

2008 APPRAISAL DISTRICT REPORT OF PROPERTY VALUE — SHORT FORM

(Instructions on Back of Form)

• COMPLETE ALL SECTIONS AND SUBMIT ORIGINAL AND ONE COPY OF EACH REQUESTED DOCUMENT.

• Submit a certified recap that corresponds with the value reported on the Electronic Appraisal Roll Submission. Recap should include the breakdown of

category values, breakdown of exemptions and losses, the breakdown of land classes, productivity value schedule, tax increment financing fund(s) and

deferred taxes/increasing homesteads. Required under Sec. 25.24 and 26.01, Property Tax Code.

• See Instruction Booklet for due dates.

Appraisal District Name

AR0001

Appraisal District Number

AR0002

SPECIAL TAXING UNIT(S)

AR0003

AR0100

Jurisdiction Number _________________________________

Jurisdiction Name _____________________________________

AR0004

AR0005

Total Value __________________________________________

Taxable Value _________________________________________

(Does not include totally exempt property)

TAX RATE INFORMATION

Maintenance & Operations

Interest & Sinking Fund

Total Tax Rate

AR0106

AR0107

AR0108

Tax Rate: _________________________________

Tax Rate: ____________________________________

=

______________________________

AR0109

Total Taxes Levied in 2008 (Round to nearest whole dollar). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

AR0003

AR0100

Jurisdiction Number _________________________________

Jurisdiction Name _____________________________________

AR0004

AR0005

Total Value __________________________________________

Taxable Value _________________________________________

(Does not include totally exempt property)

TAX RATE INFORMATION

Maintenance & Operations

Interest & Sinking Fund

Total Tax Rate

AR0106

AR0107

AR0108

Tax Rate: _________________________________

Tax Rate: ____________________________________

=

______________________________

AR0109

Total Taxes Levied in 2008 (Round to nearest whole dollar). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

AR0003

AR0100

Jurisdiction Number _________________________________

Jurisdiction Name _____________________________________

AR0004

AR0005

Total Value __________________________________________

Taxable Value _________________________________________

(Does not include totally exempt property)

TAX RATE INFORMATION

Maintenance & Operations

Interest & Sinking Fund

Total Tax Rate

AR0106

AR0107

AR0108

Tax Rate: _________________________________

Tax Rate: ____________________________________

=

______________________________

AR0109

Total Taxes Levied in 2008 (Round to nearest whole dollar). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

AR0003

AR0100

Jurisdiction Number _________________________________

Jurisdiction Name _____________________________________

AR0004

AR0005

Total Value __________________________________________

Taxable Value _________________________________________

(Does not include totally exempt property)

TAX RATE INFORMATION

Maintenance & Operations

Interest & Sinking Fund

Total Tax Rate

AR0106

AR0107

AR0108

Tax Rate: _________________________________

Tax Rate: ____________________________________

=

______________________________

AR0109

Total Taxes Levied in 2008 (Round to nearest whole dollar). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

By signing this report, I agree that the values are true and correct as certified by

Return original and one copy to:

the Chief Appraiser.

COMPTROLLER OF PUBLIC ACCOUNTS

Official authorized by Appraisal District

Date

Property Tax Division

Reporting Section

P.O. Box 13528

Print name/Title

Phone (area code and number)

Austin, Texas 78711-3528

If you have any questions about this report, please call the Reporting Section at (800) 252-9121.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2