Form 6cs - Sharing Of Research Credits (Draft) - 2014

ADVERTISEMENT

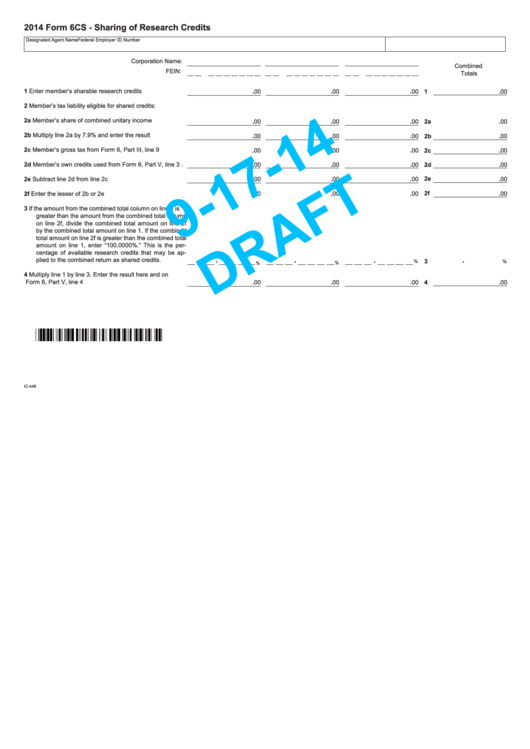

2014 Form 6CS - Sharing of Research Credits

Designated Agent Name

Federal Employer ID Number

Corporation Name:

Combined

FEIN:

Totals

1

Enter member’s sharable research credits . . . . . . . . . . .

.00

.00

.00

1

.00

2

Member’s tax liability eligible for shared credits:

2a Member’s share of combined unitary income . . . . . . . . .

.00

.00

.00

2a

.00

2b Multiply line 2a by 7 .9% and enter the result . . . . . . . . . .

.00

.00

.00

.00

2b

2c Member’s gross tax from Form 6, Part III, line 9 . . . . . . .

.00

.00

.00

.00

2c

2d Member’s own credits used from Form 6, Part V, line 3 .

.00

.00

.00

2d

.00

2e

2e Subtract line 2d from line 2c . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

.00

.00

.00

2f

.00

2f

Enter the lesser of 2b or 2e . . . . . . . . . . . . . . . . . . . . . . .

3

If the amount from the combined total column on line 1 is

greater than the amount from the combined total column

on line 2f, divide the combined total amount on line 2f

by the combined total amount on line 1 . If the combined

total amount on line 2f is greater than the combined total

amount on line 1, enter “100 .0000% .” This is the per-

centage of available research credits that may be ap-

.

.

.

.

plied to the combined return as shared credits .

3

%

%

%

%

4

Multiply line 1 by line 3 . Enter the result here and on

Form 6, Part V, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

4

.00

IC-448

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1