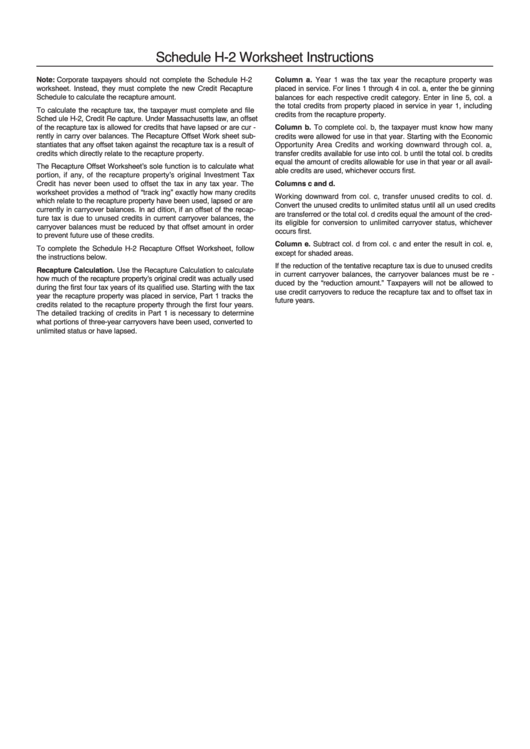

Schedule H-2 Worksheet Instructions

ADVERTISEMENT

Schedule H-2 Worksheet Instructions

Note: Corporate taxpayers should not complete the Schedule H-2

Column a. Year 1 was the tax year the recapture property was

worksheet. Instead, they must complete the new Credit Recapture

placed in service. For lines 1 through 4 in col. a, enter the be ginning

Schedule to calculate the recapture amount.

balances for each respective credit category. Enter in line 5, col. a

the total credits from property placed in service in year 1, including

To calculate the recapture tax, the taxpayer must complete and file

credits from the recapture property.

Sched ule H-2, Credit Re capture. Under Massachusetts law, an offset

of the recapture tax is allowed for credits that have lapsed or are cur -

Column b. To complete col. b, the taxpayer must know how many

rently in carry over balances. The Recapture Offset Work sheet sub-

credits were allowed for use in that year. Starting with the Economic

stantiates that any offset taken against the recapture tax is a result of

Opportunity Area Credits and working downward through col. a,

credits which directly relate to the recapture property.

transfer credits available for use into col. b until the total col. b credits

equal the amount of credits allowable for use in that year or all avail-

The Recapture Offset Worksheet’s sole function is to calculate what

able credits are used, whichever occurs first.

portion, if any, of the recapture property’s original Investment Tax

Credit has never been used to offset the tax in any tax year. The

Columns c and d.

worksheet provides a method of “track ing” exactly how many credits

Working downward from col. c, transfer unused credits to col. d.

which relate to the recapture property have been used, lapsed or are

Convert the unused credits to unlimited status until all un used credits

currently in carryover balances. In ad dition, if an offset of the recap-

are transferred or the total col. d credits equal the amount of the cred-

ture tax is due to unused credits in current carryover balances, the

its eligible for conversion to unlimited carryover status, whichever

carryover balances must be reduced by that offset amount in order

occurs first.

to prevent future use of these credits.

Column e. Subtract col. d from col. c and enter the result in col. e,

To complete the Schedule H-2 Recapture Offset Worksheet, follow

except for shaded areas.

the instructions below.

If the reduction of the tentative recapture tax is due to unused credits

Recapture Calculation. Use the Recapture Calculation to calculate

in current carryover balances, the carryover balances must be re -

how much of the recapture property’s original credit was actually used

duced by the “reduction amount.” Taxpayers will not be allowed to

during the first four tax years of its qualified use. Starting with the tax

use credit carryovers to reduce the recapture tax and to offset tax in

year the recapture property was placed in service, Part 1 tracks the

future years.

credits related to the recapture property through the first four years.

The detailed tracking of credits in Part 1 is necessary to determine

what portions of three-year carryovers have been used, converted to

unlimited status or have lapsed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1