Form 39r - Idaho Supplemental Schedule - Idaho State Tax Commission - 2002 Page 2

ADVERTISEMENT

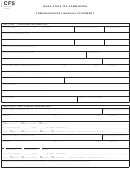

Form 39R (2002)

TC39R021-2

9-06-02

Name(s) as shown on return

Social Security Number

C. Credit for Income Tax Paid to Other States. See instructions, page 20.

1

Attach a copy of the

1. Idaho tax, line 22, Form 40 ............................................................................

00

income tax return and a

2

2. Other state's adjusted income .......................................................................

00

separate Form 39R for

3

each state for which a

3. Idaho adjusted income from line 13, Form 40 ................................................

00

credit is claimed.

4

%

4. Divide line 2 by line 3. Enter percentage here. ..............................................

5. Multiply line 1 by line 4. Enter amount here. .........................................................................................

5

00

6. Other state's tax due less its income tax credits .....................................................................................

6

00

7. Enter the smaller of lines 5 or 6 here and on line 24, Form 40.

7

00

D. Maintaining a Home for a Family Member Age 65 or Older, or a Family Member With a

Developmental Disability. See instructions, page 21.

1.

Did you maintain a home for an immediate family member age 65 or older and provide more than

Yes

No

one-half of his/her support? You and your spouse do not qualify. .......................................................

2.

Did you maintain a home for an immediate family member with a developmental disability and

Yes

No

provide more than one-half of his/her support? You and your spouse may qualify. .............................

If you answered YES to either question, complete lines 3 and 4.

3.

List each family member you are claiming:

Name of Family Member

Check here if

Social Security Number

Relationship to Person

Date of Birth of

developmentally

of Family Member

Filing Return

Family Member

disabled

4.

Total amount claimed ($100 for each qualifying member but not more than $300).

Enter on line 50, Form 40.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2