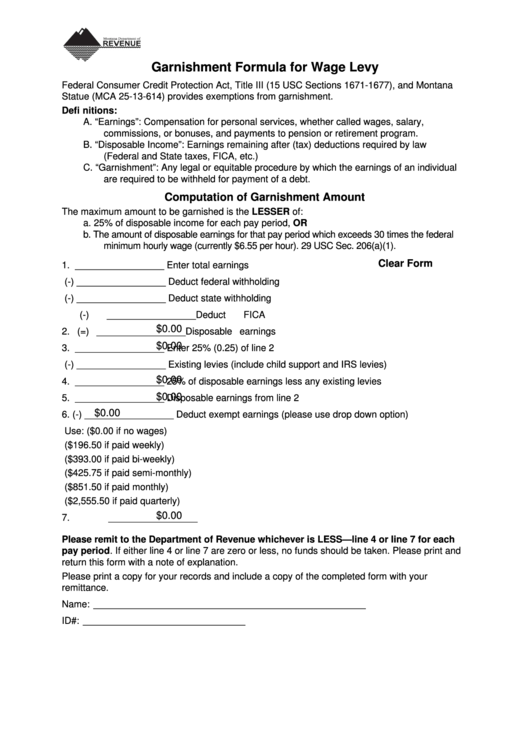

Garnishment Formula for Wage Levy

Federal Consumer Credit Protection Act, Title III (15 USC Sections 1671-1677), and Montana

Statue (MCA 25-13-614) provides exemptions from garnishment.

Defi nitions:

A.

“Earnings”: Compensation for personal services, whether called wages, salary,

commissions, or bonuses, and payments to pension or retirement program.

B.

“Disposable Income”: Earnings remaining after (tax) deductions required by law

(Federal and State taxes, FICA, etc.)

C.

“Garnishment”: Any legal or equitable procedure by which the earnings of an individual

are required to be withheld for payment of a debt.

Computation of Garnishment Amount

The maximum amount to be garnished is the LESSER of:

a.

25% of disposable income for each pay period, OR

b.

The amount of disposable earnings for that pay period which exceeds 30 times the federal

minimum hourly wage (currently $6.55 per hour). 29 USC Sec. 206(a)(1).

Clear Form

1.

_________________ Enter total earnings

(-) _________________ Deduct federal withholding

(-) _________________ Deduct state withholding

(-) _________________ Deduct FICA

$0.00

2. (=) _________________ Disposable earnings

$0.00

3.

_________________ Enter 25% (0.25) of line 2

(-) _________________ Existing levies (include child support and IRS levies)

$0.00

4.

_________________ 25% of disposable earnings less any existing levies

$0.00

5.

_________________ Disposable earnings from line 2

$0.00

6. (-) _________________ Deduct exempt earnings (please use drop down option)

Use: ($0.00 if no wages)

($196.50 if paid weekly)

($393.00 if paid bi-weekly)

($425.75 if paid semi-monthly)

($851.50 if paid monthly)

($2,555.50 if paid quarterly)

$0.00

7.

_________________

Please remit to the Department of Revenue whichever is LESS—line 4 or line 7 for each

pay period. If either line 4 or line 7 are zero or less, no funds should be taken. Please print and

return this form with a note of explanation.

Please print a copy for your records and include a copy of the completed form with your

remittance.

Name: ____________________________________________________

ID#: _______________________________

1

1