Form Ador 50-4004 - Update Card

Download a blank fillable Form Ador 50-4004 - Update Card in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Ador 50-4004 - Update Card with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

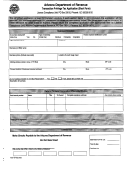

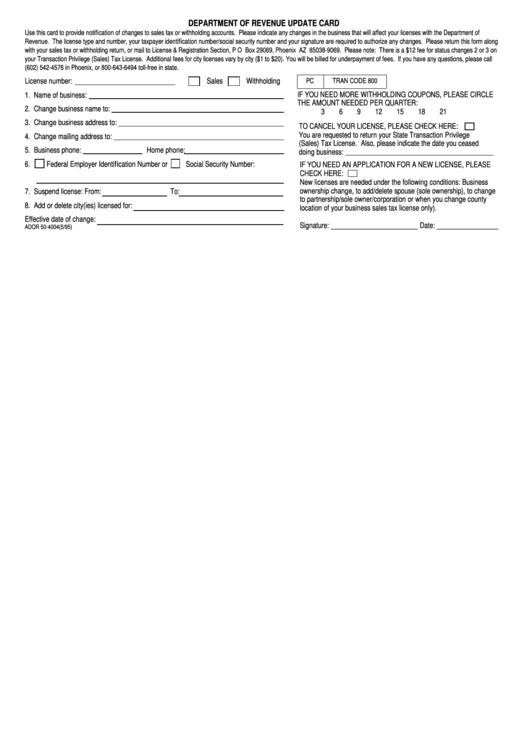

DEPARTMENT OF REVENUE UPDATE CARD

Use this card to provide notification of changes to sales tax or withholding accounts. Please indicate any changes in the business that will affect your licenses with the Department of

Revenue. The license type and number, your taxpayer identification number/social security number and your signature are required to authorize any changes. Please return this form along

with your sales tax or withholding return, or mail to License & Registration Section, P O Box 29069, Phoenix AZ 85038-9069. Please note: There is a $12 fee for status changes 2 or 3 on

your Transaction Privilege (Sales) Tax License. Additional fees for city licenses vary by city ($1 to $20). You will be billed for underpayment of fees. If you have any questions, please call

(602) 542-4576 in Phoenix, or 800-643-6494 toll-free in state.

License number:

Sales

Withholding

PC

TRAN CODE 800

IF YOU NEED MORE WITHHOLDING COUPONS, PLEASE CIRCLE

1. Name of business:

THE AMOUNT NEEDED PER QUARTER:

2. Change business name to:

3

6

9

12

15

18

21

3. Change business address to:

TO CANCEL YOUR LICENSE, PLEASE CHECK HERE:

You are requested to return your State Transaction Privilege

4. Change mailing address to:

(Sales) Tax License. Also, please indicate the date you ceased

5. Business phone:

Home phone:

doing business:

6.

Federal Employer Identification Number or

Social Security Number:

IF YOU NEED AN APPLICATION FOR A NEW LICENSE, PLEASE

CHECK HERE:

New licenses are needed under the following conditions: Business

ownership change, to add/delete spouse (sole ownership), to change

7. Suspend license: From:

To:

to partnership/sole owner/corporation or when you change county

8. Add or delete city(ies) licensed for:

location of your business sales tax license only).

Effective date of change:

Signature: ________________________ Date: _________________

ADOR 50-4004(5/95)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1