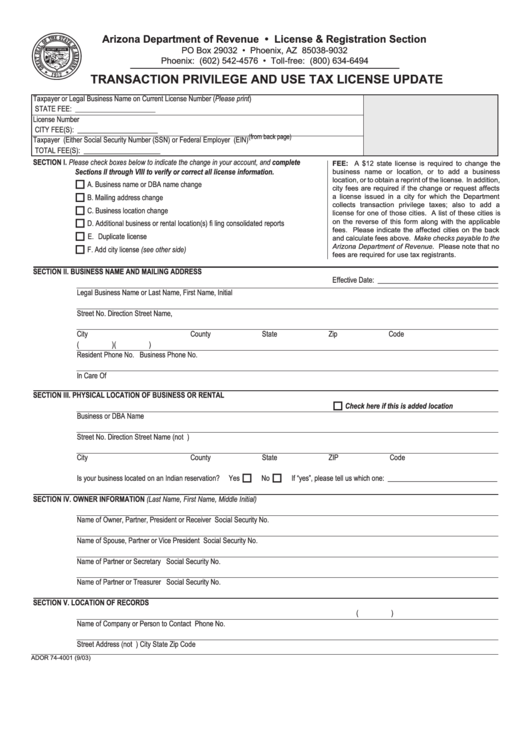

Form Ador 74-4001 - Transaction Privilege And Use Tax License Update - Arizona Department Of Revenue

ADVERTISEMENT

Arizona Department of Revenue • License & Registration Section

PO Box 29032 • Phoenix, AZ 85038-9032

Phoenix: (602) 542-4576 • Toll-free: (800) 634-6494

TRANSACTION PRIVILEGE AND USE TAX LICENSE UPDATE

Taxpayer or Legal Business Name on Current License Number (Please print)

STATE FEE: ______________________

License Number

CITY FEE(S): ______________________

(from back page)

Taxpayer I.D. No. (Either Social Security Number (SSN) or Federal Employer I.D. No. (EIN)

TOTAL FEE(S): _____________________

SECTION I. Please check boxes below to indicate the change in your account, and complete

FEE: A $12 state license is required to change the

Sections II through VIII to verify or correct all license information.

business name or location, or to add a business

location, or to obtain a reprint of the license. In addition,

A. Business name or DBA name change

city fees are required if the change or request affects

a license issued in a city for which the Department

B. Mailing address change

collects transaction privilege taxes; also to add a

C. Business location change

license for one of those cities. A list of these cities is

on the reverse of this form along with the applicable

D. Additional business or rental location(s) fi ling consolidated reports

fees. Please indicate the affected cities on the back

E. Duplicate license

and calculate fees above. Make checks payable to the

Arizona Department of Revenue. Please note that no

F. Add city license (see other side)

fees are required for use tax registrants.

SECTION II. BUSINESS NAME AND MAILING ADDRESS

Effective Date: _________________________________

Legal Business Name or Last Name, First Name, Initial

Street No.

Direction

Street Name, P.O. Box or Route No.

City

County

State

Zip Code

(

)

(

)

Resident Phone No.

Business Phone No.

In Care Of

SECTION III.

PHYSICAL LOCATION OF BUSINESS OR RENTAL

Check here if this is added location

Business or DBA Name

Street No.

Direction

Street Name (not P.O. Box or Route No.)

City

County

State

ZIP Code

Is your business located on an Indian reservation?

Yes

No

If “yes”, please tell us which one: ______________________________

SECTION IV.

OWNER INFORMATION (Last Name, First Name, Middle Initial)

Name of Owner, Partner, President or Receiver

Social Security No.

Name of Spouse, Partner or Vice President

Social Security No.

Name of Partner or Secretary

Social Security No.

Name of Partner or Treasurer

Social Security No.

SECTION V.

LOCATION OF RECORDS

(

)

Name of Company or Person to Contact

Phone No.

Street Address (not P.O. Box or Route No. )

City

State

Zip Code

ADOR 74-4001 (9/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2