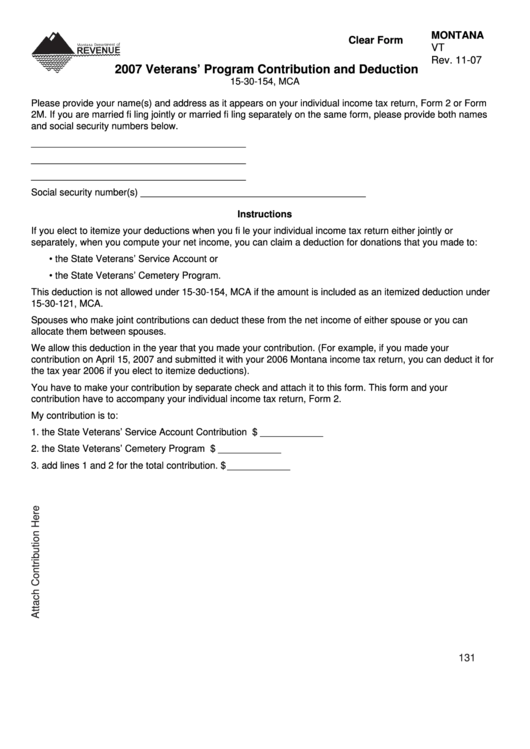

MONTANA

Clear Form

VT

Rev. 11-07

2007 Veterans’ Program Contribution and Deduction

15-30-154, MCA

Please provide your name(s) and address as it appears on your individual income tax return, Form 2 or Form

2M. If you are married fi ling jointly or married fi ling separately on the same form, please provide both names

and social security numbers below.

_________________________________________

_________________________________________

_________________________________________

Social security number(s) ___________________________________________

Instructions

If you elect to itemize your deductions when you fi le your individual income tax return either jointly or

separately, when you compute your net income, you can claim a deduction for donations that you made to:

•

the State Veterans’ Service Account or

•

the State Veterans’ Cemetery Program.

This deduction is not allowed under 15-30-154, MCA if the amount is included as an itemized deduction under

15-30-121, MCA.

Spouses who make joint contributions can deduct these from the net income of either spouse or you can

allocate them between spouses.

We allow this deduction in the year that you made your contribution. (For example, if you made your

contribution on April 15, 2007 and submitted it with your 2006 Montana income tax return, you can deduct it for

the tax year 2006 if you elect to itemize deductions).

You have to make your contribution by separate check and attach it to this form. This form and your

contribution have to accompany your individual income tax return, Form 2.

My contribution is to:

1. the State Veterans’ Service Account Contribution ........................................... $ ____________

2. the State Veterans’ Cemetery Program ........................................................... $ ____________

3. add lines 1 and 2 for the total contribution. ...................................................... $ ____________

131

1

1