Form Vat-11d - Trading And Profit Loss Account -

ADVERTISEMENT

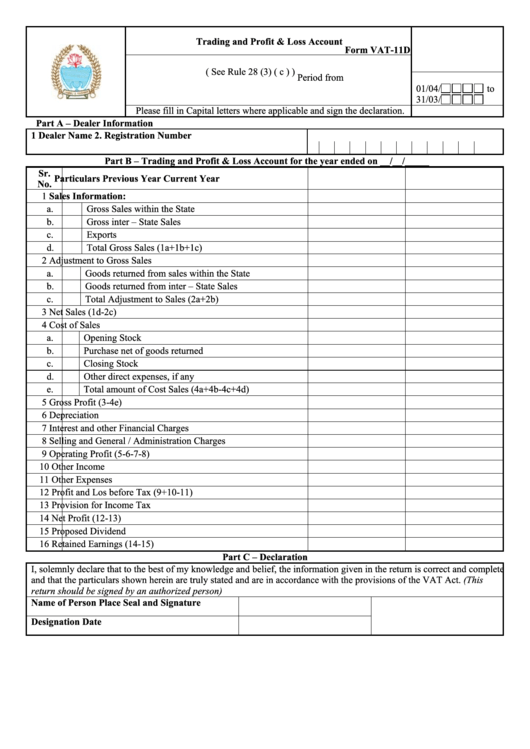

Trading and Profit & Loss Account

Form VAT-11D

( See Rule 28 (3) ( c ) )

Period from

01/04/

to

31/03/

Please fill in Capital letters where applicable and sign the declaration.

Part A – Dealer Information

1 Dealer Name

2. Registration Number

Part B – Trading and Profit & Loss Account for the year ended on __/__/_____

Sr.

Particulars

Previous Year

Current Year

No.

1

Sales Information:

a.

Gross Sales within the State

b.

Gross inter – State Sales

c.

Exports

d.

Total Gross Sales (1a+1b+1c)

2

Adjustment to Gross Sales

a.

Goods returned from sales within the State

b.

Goods returned from inter – State Sales

c.

Total Adjustment to Sales (2a+2b)

3

Net Sales (1d-2c)

4

Cost of Sales

a.

Opening Stock

b. Purchase net of goods returned

c.

Closing Stock

d. Other direct expenses, if any

e.

Total amount of Cost Sales (4a+4b-4c+4d)

5

Gross Profit (3-4e)

6

Depreciation

7

Interest and other Financial Charges

8

Selling and General / Administration Charges

9

Operating Profit (5-6-7-8)

10

Other Income

11

Other Expenses

12

Profit and Los before Tax (9+10-11)

13

Provision for Income Tax

14

Net Profit (12-13)

15

Proposed Dividend

16

Retained Earnings (14-15)

Part C – Declaration

I, solemnly declare that to the best of my knowledge and belief, the information given in the return is correct and complete

and that the particulars shown herein are truly stated and are in accordance with the provisions of the VAT Act. (This

return should be signed by an authorized person)

Name of Person

Place

Seal and Signature

Designation

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1