Save

Reset

Print

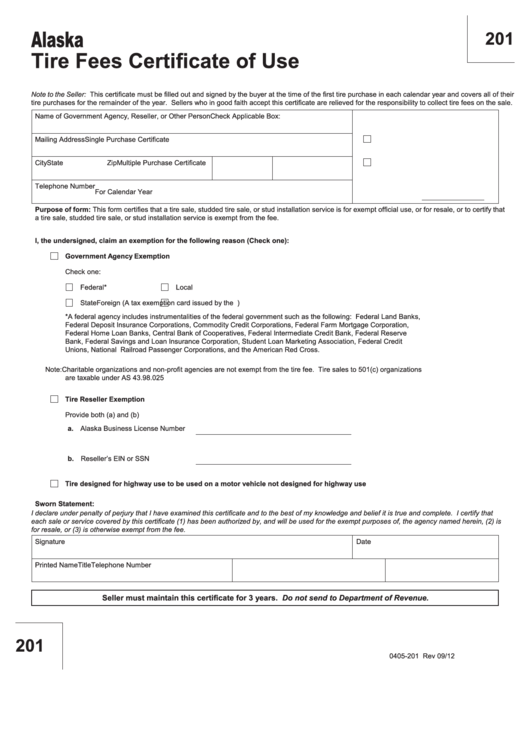

Alaska

201

Tire Fees Certificate of Use

Note to the Seller: This certificate must be filled out and signed by the buyer at the time of the first tire purchase in each calendar year and covers all of their

tire purchases for the remainder of the year. Sellers who in good faith accept this certificate are relieved for the responsibility to collect tire fees on the sale.

Name of Government Agency, Reseller, or Other Person

Check Applicable Box:

Mailing Address

Single Purchase Certificate

City

State

Zip

Multiple Purchase Certificate

Telephone Number

For Calendar Year

Purpose of form: This form certifies that a tire sale, studded tire sale, or stud installation service is for exempt official use, or for resale, or to certify that

a tire sale, studded tire sale, or stud installation service is exempt from the fee.

I, the undersigned, claim an exemption for the following reason (Check one):

Government Agency Exemption

Check one:

Federal*

Local

State

Foreign (A tax exemption card issued by the U.S. Department of State is required)

*A federal agency includes instrumentalities of the federal government such as the following: Federal Land Banks,

Federal Deposit Insurance Corporations, Commodity Credit Corporations, Federal Farm Mortgage Corporation,

Federal Home Loan Banks, Central Bank of Cooperatives, Federal Intermediate Credit Bank, Federal Reserve

Bank, Federal Savings and Loan Insurance Corporation, Student Loan Marketing Association, Federal Credit

Unions, National Railroad Passenger Corporations, and the American Red Cross.

Note: Charitable organizations and non-profit agencies are not exempt from the tire fee. Tire sales to 501(c) organizations

are taxable under AS 43.98.025

Tire Reseller Exemption

Provide both (a) and (b)

a. Alaska Business License Number

b. Reseller’s EIN or SSN

Tire designed for highway use to be used on a motor vehicle not designed for highway use

Sworn Statement:

I declare under penalty of perjury that I have examined this certificate and to the best of my knowledge and belief it is true and complete. I certify that

each sale or service covered by this certificate (1) has been authorized by, and will be used for the exempt purposes of, the agency named herein, (2) is

for resale, or (3) is otherwise exempt from the fee.

Signature

Date

Printed Name

Title

Telephone Number

Seller must maintain this certificate for 3 years. Do not send to Department of Revenue.

201

0405-201 Rev 09/12

1

1