Alaska Tire Fees Quarterly Return Instructions

ADVERTISEMENT

Alaska Tire Fees Quarterly Return Instructions

General Information

ACH Debit (EFT) - OTIS accommodates Automated Clearing

House (ACH) debit payments. If your bank account has a

In the State of Alaska there is a $2.50 tire fee imposed on the

debit block, your online payment request will be rejected by

sale of all new tires (whether studded or not) for motor vehicles

your bank. Rejected payments may result in late payment

designed for use on a highway. New tires include unused

penalties and/or interest.

tires customarily sold by tire dealers as well as retreaded or

remanufactured tires. Tires subject to the fee include automobile,

If you think your bank account has a debit block, contact your

motorcycle, truck, and trailer tires, including tires for rigs and

bank before making an online payment to register the State of

devices intended to be hitched or trailed behind a motor vehicle

Alaska as an authorized ACH debit originator. The company ID

designed for highway use. Off-road tires such as those used on

for the Alaska Department of Revenue is 0000902050.

lawn mowers, farm equipment, racing cars, and similar vehicles

that are not designed by the manufacturer for highway use are

Credit Cards or ACH Credit - OTIS cannot accept credit cards

not subject to the fee.

or ACH credit transactions for this tax program.

An additional $5.00 fee is imposed on the sale of tires with metal

Wire Transfers - If you are paying by wire transfer, log on to the

studs or spikes weighing more than 1.1 grams each (“heavy

OTIS website at for instructions.

studs”). The $5.00 fee also applies to the installation of heavy

metal studs in a new or used tire.

Checks - Note that if your total payment exceeds $100,000 you

Sales to a federal, state, or local government agency for official

are required to pay electronically or by wire transfer. If you are

paying by check, make your check payable to the State of Alaska

use are exempt from both the $2.50 fee and the $5.00 fee on tires

and mail it with your return to:

with heavy metal studs. Sales for resale are also exempt from

both portions of the fee. A certificate of use must be obtained for

TAX DIVISION

these sales. Other transfers that are not subject to the fee include

ALASKA DEPARTMENT OF REVENUE

the sale of used tires and certain replacements of defective tires.

Sales to nonprofit and charitable organizations are not exempt

PO BOX 110420

JUNEAU AK 99811-0420

from the tire fees.

Tire fees are due at the time of the sale or service. The seller

Penalties

Late filing of return. Returns not filed by the due date are subject

is required to collect the fees at the time of the sale or service

and the seller is also required to file a return and remit the fees

to a failure to file penalty of 5% of the unpaid fees for each 30 day

collected to the Alaska Department of Revenue. The seller is

period or portion of a period the return is late, up to a maximum

of 25%.

liable for the fees if the seller fails to collect the fees. A seller is

liable for the fees, as well as penalties and interest in the same

manner as if the fees were taxes under AS 43.

Late payment of tax. If the full amount of fees is not paid when

due, the return is subject to a failure to pay penalty of 5% of the

A return is required to be filed for each calendar quarter. The

unpaid fees for each 30 day period or portion of a period that the

payment is late, up to a maximum of 25%. If during any period

return is due the 30th day of the month following the end of

or portion of a period, both the failure to file and failure to pay

the calendar quarter:

penalties are applicable, only the failure to file penalty is imposed.

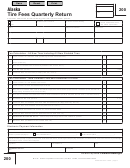

Quarter Qtr Ending Date

Return Due Date

1

March 31

April 30

Interest

2

June 30

July 30

Under Alaska Statute 43.05.225, interest will be assessed on any

3

September 30

October 30

unpaid or delinquent fees. Interest is compounded quarterly at

4

December 31

January 30

the applicable rate each quarter. Refer to or

contact the Tax Division for applicable rates.

How To File

Records

File online return – File your Tire Fees Quarterly Return using

All fee payers are required to keep adequate records pertaining

the Online Tax Information System (OTIS) at:

to each line item on the return. Records may include, but are

gov. You may also pay your tax online at this site.

not limited to, general ledgers, invoices, and inventory schedules.

File paper return - Mail completed return to:

Line By Line Instructions

TAX DIVISION

A person subject to the fee should refer to the statute, AS

43.98.025 for further guidance before filing the return.

ALASKA DEPARTMENT OF REVENUE

PO BOX 110420

JUNEAU AK 99811-0420

Top of Page

• Enter the EIN or SSN and Alaska business license number of

the person filing the return (the seller).

Payment

• Enter the calendar quarter ending date for which the return is

Pay your taxes using the Online Tax Information System (OTIS) at

being filed (see above).

. Note that you must be an existing taxpayer

• Check the box if the filing is to amend a prior return.

with the Tax Division to pay electronically. If you are a first-time

• Enter the name, mailing address, e-mail address, telephone

taxpayer, contact the Tax Division at (907) 465-2320 or visit www.

number and fax numbers for the seller.

tax.alaska.gov for information.

0405-200i - Rev 09/12 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2