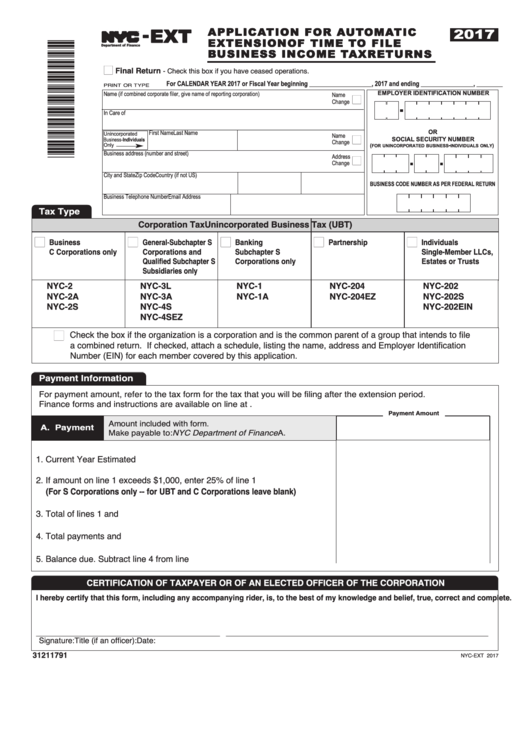

Form Nyc-Ext - Application For Automatic Extension Of Time To File Business Income Tax Returns - 2017

ADVERTISEMENT

- EXT

2017

TM

Department of Finance

n

Final Return

- Check this box if you have ceased operations.

For CALENDAR YEAR 2017 or Fiscal Year beginning ___________________, 2017 and ending ________________, ________

PRINT OR TYPE

EMPLOYER IDENTIFICATION NUMBER

Name (if combined corporate filer, give name of reporting corporation)

Name

n

Change

In Care of

OR

First Name

Last Name

Unincorporated

Name

n

SOCIAL SECURITY NUMBER

Business-Individuals

Change

-

Only

(

)

FOR UNINCORPORATED BUSINESS

INDIVIDUALS ONLY

Business address (number and street)

Address

n

Change

City and State

Zip Code

Country (if not US)

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

Business Telephone Number

Email Address

Tax Type

Corporation Tax

Unincorporated Business Tax (UBT)

n

n

n

n

n

Business

General-Subchapter S

Banking

Partnership

Individuals

C Corporations only

Corporations and

Subchapter S

Single-Member LLCs,

Qualified Subchapter S

Corporations only

Estates or Trusts

Subsidiaries only

NYC-2

NYC-3L

NYC-1

NYC-204

NYC-202

NYC-2A

NYC-3A

NYC-1A

NYC-204EZ

NYC-202S

NYC-2S

NYC-4S

NYC-202EIN

NYC-4SEZ

n

Check the box if the organization is a corporation and is the common parent of a group that intends to file

a combined return. If checked, attach a schedule, listing the name, address and Employer Identification

Number (EIN) for each member covered by this application.

Payment Information

For payment amount, refer to the tax form for the tax that you will be filing after the extension period.

Finance forms and instructions are available on line at NYC.gov/finance.

Payment Amount

Amount included with form.

A. Payment

Make payable to: NYC Department of Finance........................A.

1. Current Year Estimated Tax...................................................................... 1. ________________________________

2. If amount on line 1 exceeds $1,000, enter 25% of line 1

(For S Corporations only -- for UBT and C Corporations leave blank)......... 2. ________________________________

3. Total of lines 1 and 2................................................................................. 3. ________________________________

4. Total payments and credits....................................................................... 4. ________________________________

5. Balance due. Subtract line 4 from line 3................................................... 5. ________________________________

CERTIFICATION OF TAXPAYER OR OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this form, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

______________________________________________________ ______________________________________________

_______________________________

Signature:

Title (if an officer):

Date:

31211791

NYC-EXT 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4