Form Ct-1120k - Business Tax Credit Summary - 2011 Page 2

ADVERTISEMENT

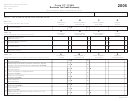

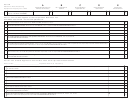

Part I-D

A

B

C

D

E

Tax Credits With Carryforward

Carryforward Amount From

2011 Credit

Amount Applied to

Amount Applied to Other

Carryforward

Provisions

Previous Income Years

Amount Claimed

Corporation Tax

Taxes or Exchanged

Amount to 2012

19 Housing Program Contribution

00

00

00

00

See instructions. Form CT-1120 HPC

00

00

00

00

20 Hiring Incentive - Form CT-1120 HIC

21 Reserved for future use

22 Research and Experimental Expenditures

Form CT-1120RC: Enter amount

00

00

00

00

00

exchanged in Column D.

23 Research and Development

Form CT-1120 RDC: Enter amount

00

00

00

00

00

exchanged in Column D.

24 Fixed Capital Investment

00

00

00

00

Form CT-1120 FCIC

25 Human Capital Investment

00

00

00

00

Form CT-1120 HCIC

26 Insurance Reinvestment Fund

00

00

00

00

00

Form CT-IRF

27 Small Business Administration Guaranty

00

00

00

00

Fee - Form CT-1120 SBA

28 Historic Homes Rehabilitation

00

00

00

00

00

Form CT-1120HH

00

00

00

00

29 Donation of Land - Form CT-1120DL

30 Historic Structures Rehabilitation

00

00

00

00

00

Form CT-1120HS

00

00

00

00

00

31 Historic Preservation - Form CT-1120HP

32 Urban and Industrial Site Reinvestment

00

00

00

00

00

Form CT-UISR

33 Reserved for future use

34 Reserved for future use

35 Total Part I-D: Add Lines 19 through 32

in Columns A through E. Do not include

amounts on Line 22 and Line 23 in

00

00

00

00

00

Column D.

Form CT-1120K (Rev. 12/11)

Page 2 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3