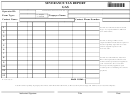

Form 3000 - Severance Tax Report Gas - Wyoming Department Of Revenue

ADVERTISEMENT

INSTRUCTIONS FOR FORM 3000: SEVERANCE TAX REPORT GAS

USE Form 3000 TO REPORT GAS AND PLANT PRODUCTS INCLUDING PLANT

CONDENSATE (liquids separated at a processing plant).

REPORT ALL VOLUMES AND VALUES (EXCEPT TAX FIELDS) ROUNDED TO THE

NEAREST WHOLE NUMBER. TAX MUST BE REPORTED TO THE CENT.

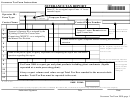

Operator ID – Enter the Taxpayer's Operator ID as assigned by the Wyoming Oil and Gas

Conservation Commission (WOGCC), or as assigned by the Mineral Tax Division of the Wyoming

Department of Revenue.

Form Type -

Enter "O" for an Original Report. Enter "A" for an Amended Report.

Taxpayer Name – Enter Taxpayer's name. Do not enter a tax agent.

Contact Name - Enter the name of the person who can answer questions about this form.

Contact Phone Number - Enter the Contact person’s phone number.

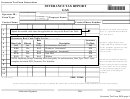

Production Period - Month and year (mmyyyy). If you qualify as an annual filer, report production for

the entire year on one line as December (12yyyy).

Reporting Group Number - Enter the five digits Reporting Group Number assigned by the Mineral Tax

Division.

Rate Code - Enter the proper rate code identifier for the Reporting Group (see Rate Code Table).

Form 3000 is used to enter the combined Rate Code total for a specific Reporting Group. Individual

wells in a Reporting Group that qualify for well incentives must also be itemized on Form 3002,

Severance Tax Schedule Gas Well Incentive Reporting.

Gross Sales Volume - Operators, enter gross MCF sold, after deducting gross MCF taken in-kind by

interest owners who are reporting on their own behalf. Take in-kind interest owners enter gross MCF

taken in-kind.

Gross Sales Value - Enter the gross sales value for the production period. Gross Sales Value includes

all revenue relating to the production for the reported period, including tax reimbursements and all

other revenue received or credited to all interest owners not taking in-kind and reporting on their own

behalf, and including all Federal, State, or Tribal royalty owner's interest.

Exempt Royalty, Processing, and Transportation - Enter the value of the Federal, State, or Tribal

Royalty exemptions, combined with the total allowable Transportation costs, and the total allowable

Processing deduction.

Taxable Value - Enter the remainder of Gross Sales Value minus reported Exempt Royalty,

Transportation, and Processing.

Total Tax Due - Equals taxable value times the applicable tax rate, per the Rate Code Table.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8