Form 3000 - Severance Tax Report Gas - Wyoming Department Of Revenue Page 5

ADVERTISEMENT

Severance Tax Form Instructions

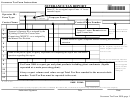

6WDWH RI :\RPLQJ

3000

SEVERANCE TAX REPORT

'HSDUWPHQW RI 5HYHQXH

:HVW WK 6WUHHW

GAS

&KH\HQQH :<

DEPARTMENT OF REVENUE USE ONLY:

Operator ID:

O - Original

Form Type:

Taxpayer Name:

A - Amended

Contact Name:

Contact Phone Number:

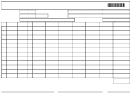

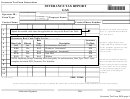

352'8&7,21

5(3257,1*

5$7(

*5266 6$/(6

*5266 6$/(6

(;(037 52<$/7<

7$;$%/(

727$/ 7$; '8(

3(5,2'

*5283

&2'(

92/80(

9$/8(

352&(66,1* $1'

9$/8(

PP\\\\

180%(5

75$163257$7,21

NOTE: For amended returns (Form

1

Type ‘A’) report REPLACEMENT

Enter the gross sales value for the production

VALUES ONLY.

2

period. Gross Sales Value includes all

revenue relating to the production for the

3

reported period, including tax

Enter the remainder of

reimbursements and all other revenue

NOTE: A change in Rate Code

4

Gross Sales Value minus

received or credited to all interest owners not

requires BOTH an amended report

Exempt Royalty and

taking in-kind and reporting on their own

for the originally reported rate code

5

and an original report for the

Transportation.

behalf, and including all Federal, State, or

new rate code.

6

Tribal royalty owner's, not taking royalty in-

kind, interest.

7

NOTE: For amendments Total Tax

8

Enter the value of the Federal, State, or Tribal

Due is the replacement amount and

Royalty exemptions, combined with the total

will not reflect previous tax applied

9

allowable transportation costs and the total

to your account. Be sure to account

allowable processing deduction.

for tax previously applied to your

10

account prior to remitting the

payment.

11

12

MTSII 10/8/01

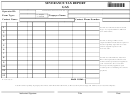

PAGE TOTAL:

I declare under penalty of perjury that I have examined this return and, to the best of my knowledge and belief, it is correct and complete.

Authorized Signature

Title

Date

Severance Tax Form 3000; page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8