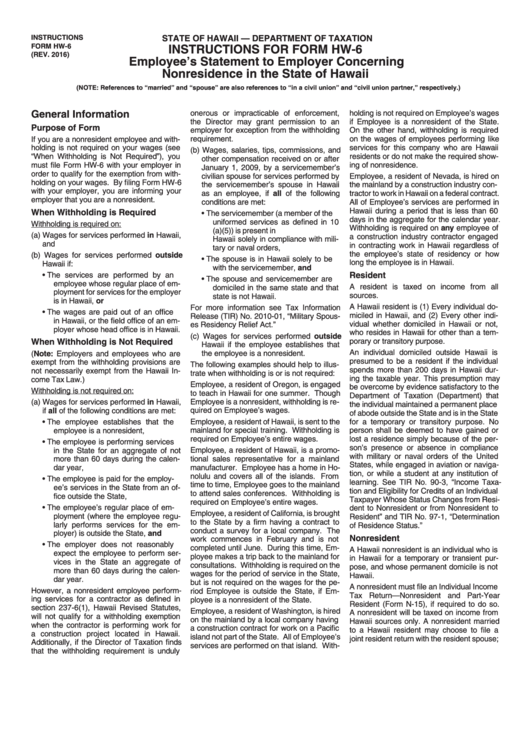

Instructions For Form Hw-6 - Employee'S Statement To Employer Concerning Nonresidence In The State Of Hawaii

ADVERTISEMENT

INSTRUCTIONS

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM HW-6

INSTRUCTIONS FOR FORM HW-6

(REV. 2016)

Employee’s Statement to Employer Concerning

Nonresidence in the State of Hawaii

(NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.)

General Information

onerous or impracticable of enforcement,

holding is not required on Employee’s wages

the Director may grant permission to an

if Employee is a nonresident of the State.

Purpose of Form

employer for exception from the withholding

On the other hand, withholding is required

If you are a nonresident employee and with-

requirement.

on the wages of employees performing like

holding is not required on your wages (see

services for this company who are Hawaii

(b) Wages, salaries, tips, commissions, and

residents or do not make the required show-

“When Withholding is Not Required”), you

other compensation received on or after

ing of nonresidence.

must file Form HW-6 with your employer in

January 1, 2009, by a servicemember’s

order to qualify for the exemption from with-

civilian spouse for services performed by

Employee, a resident of Nevada, is hired on

holding on your wages. By filing Form HW-6

the servicemember’s spouse in Hawaii

the mainland by a construction industry con-

with your employer, you are informing your

as an employee, if all of the following

tractor to work in Hawaii on a federal contract.

employer that you are a nonresident.

conditions are met:

All of Employee’s services are performed in

Hawaii during a period that is less than 60

When Withholding is Required

•

The servicemember (a member of the

days in the aggregate for the calendar year.

uniformed services as defined in 10

Withholding is required on:

Withholding is required on any employee of

U.S.C. section 101 (a)(5)) is present in

(a) Wages for services performed in Hawaii,

a construction industry contractor engaged

Hawaii solely in compliance with mili-

and

in contracting work in Hawaii regardless of

tary or naval orders,

the employee’s state of residency or how

(b) Wages for services performed outside

•

The spouse is in Hawaii solely to be

long the employee is in Hawaii.

Hawaii if:

with the servicemember, and

Resident

•

The services are performed by an

•

The spouse and servicemember are

employee whose regular place of em-

A resident is taxed on income from all

domiciled in the same state and that

ployment for services for the employer

sources.

state is not Hawaii.

is in Hawaii, or

A Hawaii resident is (1) Every individual do-

For more information see Tax Information

•

The wages are paid out of an office

miciled in Hawaii, and (2) Every other indi-

Release (TIR) No. 2010-01, “Military Spous-

in Hawaii, or the field office of an em-

vidual whether domiciled in Hawaii or not,

es Residency Relief Act.”

ployer whose head office is in Hawaii.

who resides in Hawaii for other than a tem-

(c) Wages for services performed outside

When Withholding is Not Required

porary or transitory purpose.

Hawaii if the employee establishes that

An individual domiciled outside Hawaii is

the employee is a nonresident.

(Note: Employers and employees who are

presumed to be a resident if the individual

exempt from the withholding provisions are

The following examples should help to illus-

spends more than 200 days in Hawaii dur-

not necessarily exempt from the Hawaii In-

trate when withholding is or is not required:

ing the taxable year. This presumption may

come Tax Law.)

Employee, a resident of Oregon, is engaged

be overcome by evidence satisfactory to the

Withholding is not required on:

to teach in Hawaii for one summer. Though

Department of Taxation (Department) that

(a) Wages for services performed in Hawaii,

Employee is a nonresident, withholding is re-

the individual maintained a permanent place

if all of the following conditions are met:

quired on Employee’s wages.

of abode outside the State and is in the State

•

The employee establishes that the

Employee, a resident of Hawaii, is sent to the

for a temporary or transitory purpose. No

employee is a nonresident,

mainland for special training. Withholding is

person shall be deemed to have gained or

required on Employee’s entire wages.

lost a residence simply because of the per-

•

The employee is performing services

son’s presence or absence in compliance

Employee, a resident of Hawaii, is a promo-

in the State for an aggregate of not

with military or naval orders of the United

more than 60 days during the calen-

tional sales representative for a mainland

States, while engaged in aviation or naviga-

dar year,

manufacturer. Employee has a home in Ho-

tion, or while a student at any institution of

nolulu and covers all of the islands. From

•

The employee is paid for the employ-

learning. See TIR No. 90-3, “Income Taxa-

time to time, Employee goes to the mainland

ee’s services in the State from an of-

tion and Eligibility for Credits of an Individual

to attend sales conferences. Withholding is

fice outside the State,

Taxpayer Whose Status Changes from Resi-

required on Employee’s entire wages.

•

The employee’s regular place of em-

dent to Nonresident or from Nonresident to

Employee, a resident of California, is brought

ployment (where the employee regu-

Resident” and TIR No. 97-1, “Determination

to the State by a firm having a contract to

larly performs services for the em-

of Residence Status.”

conduct a survey for a local company. The

ployer) is outside the State, and

Nonresident

work commences in February and is not

•

The employer does not reasonably

completed until June. During this time, Em-

A Hawaii nonresident is an individual who is

expect the employee to perform ser-

ployee makes a trip back to the mainland for

in Hawaii for a temporary or transient pur-

vices in the State an aggregate of

consultations. Withholding is required on the

pose, and whose permanent domicile is not

more than 60 days during the calen-

wages for the period of service in the State,

Hawaii.

dar year.

but is not required on the wages for the pe-

A nonresident must file an Individual Income

However, a nonresident employee perform-

riod Employee is outside the State, if Em-

Tax Return—Nonresident and Part-Year

ing services for a contractor as defined in

ployee is a nonresident of the State.

Resident (Form N-15), if required to do so.

section 237-6(1), Hawaii Revised Statutes,

Employee, a resident of Washington, is hired

A nonresident will be taxed on income from

will not qualify for a withholding exemption

on the mainland by a local company having

Hawaii sources only. A nonresident married

when the contractor is performing work for

a construction contract for work on a Pacific

to a Hawaii resident may choose to file a

a construction project located in Hawaii.

island not part of the State. All of Employee’s

joint resident return with the resident spouse;

Additionally, if the Director of Taxation finds

services are performed on that island. With-

that the withholding requirement is unduly

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2