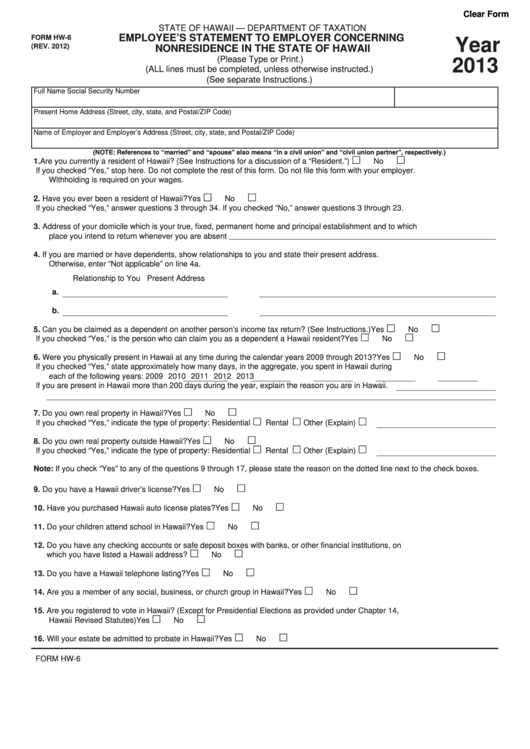

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

EMPLOYEE’S STATEMENT TO EMPLOYER CONCERNING

FORM HW-6

Year

(REV. 2012)

NONRESIDENCE IN THE STATE OF HAWAII

(Please Type or Print.)

2013

(ALL lines must be completed, unless otherwise instructed.)

(See separate Instructions.)

Full Name

Social Security Number

Present Home Address (Street, city, state, and Postal/ZIP Code)

Name of Employer and Employer’s Address (Street, city, state, and Postal/ZIP Code)

(NOTE: References to “married” and “spouse” also means “in a civil union” and “civil union partner”, respectively.)

1. Are you currently a resident of Hawaii? (See Instructions for a discussion of a “Resident.”)......................................Yes

No

If you checked “Yes,” stop here. Do not complete the rest of this form. Do not file this form with your employer.

Withholding is required on your wages.

2. Have you ever been a resident of Hawaii? .................................................................................................................Yes

No

If you checked “Yes,” answer questions 3 through 34. If you checked “No,” answer questions 3 through 23.

3. Address of your domicile which is your true, fixed, permanent home and principal establishment and to which

place you intend to return whenever you are absent

4. If you are married or have dependents, show relationships to you and state their present address.

Otherwise, enter “Not applicable” on line 4a.

Relationship to You

Present Address

a.

b.

5. Can you be claimed as a dependent on another person’s income tax return? (See Instructions.) ............................Yes

No

If you checked “Yes,” is the person who can claim you as a dependent a Hawaii resident? .......................................Yes

No

6. Were you physically present in Hawaii at any time during the calendar years 2009 through 2013? ..........................Yes

No

If you checked “Yes,” state approximately how many days, in the aggregate, you spent in Hawaii during

each of the following years:

2009

2010

2011

2012

2013

If you are present in Hawaii more than 200 days during the year, explain the reason you are in Hawaii.

7. Do you own real property in Hawaii? ..........................................................................................................................Yes

No

If you checked “Yes,” indicate the type of property: Residential

Rental

Other (Explain)

8. Do you own real property outside Hawaii? .................................................................................................................Yes

No

If you checked “Yes,” indicate the type of property: Residential

Rental

Other (Explain)

Note:

If you check “Yes” to any of the questions 9 through 17, please state the reason on the dotted line next to the check boxes.

9. Do you have a Hawaii driver’s license? ......................................................................................................................Yes

No

10. Have you purchased Hawaii auto license plates? ......................................................................................................Yes

No

11. Do your children attend school in Hawaii? .................................................................................................................Yes

No

12. Do you have any checking accounts or safe deposit boxes with banks, or other financial institutions, on

which you have listed a Hawaii address?.................................................................................................................Yes

No

13. Do you have a Hawaii telephone listing? ....................................................................................................................Yes

No

14. Are you a member of any social, business, or church group in Hawaii? ....................................................................Yes

No

15. Are you registered to vote in Hawaii? (Except for Presidential Elections as provided under Chapter 14,

Hawaii Revised Statutes) .........................................................................................................................................Yes

No

16. Will your estate be admitted to probate in Hawaii? ....................................................................................................Yes

No

FORM HW-6

1

1 2

2