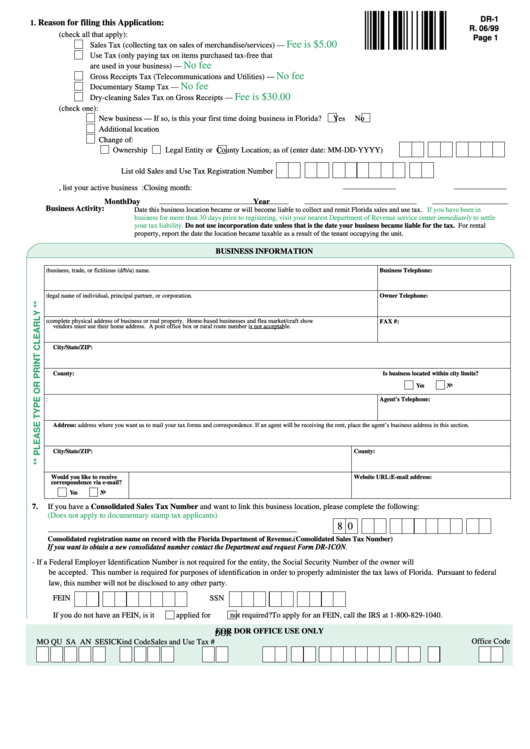

Form Dr-1 - Business Application

ADVERTISEMENT

DR-1

Reason for filing this Application:

1.

R. 06/99

A. This application is for (check all that apply):

Page 1

Fee is $5.00

Sales Tax (collecting tax on sales of merchandise/services) —

Use Tax (only paying tax on items purchased tax-free that

No fee

are used in your business) —

No fee

Gross Receipts Tax (Telecommunications and Utilities) —

No fee

Documentary Stamp Tax —

Fee is $30.00

Dry-cleaning Sales Tax on Gross Receipts —

B.

This is for a (check one):

New business — If so, is this your first time doing business in Florida?

Yes

No

Additional location

Change of:

Ownership

Legal Entity or

County Location; as of (enter date: MM-DD-YYYY)

List old Sales and Use Tax Registration Number

C.

If this is a seasonal business, list your active business months.

Opening month:

Closing month:

2.

Beginning of

Month

Day

Year

Business Activity:

Date this business location became or will become liable to collect and remit Florida sales and use tax.

If you have been in

business for more than 30 days prior to registering, visit your nearest Department of Revenue service center immediately to settle

your tax liability.

Do not use incorporation date unless that is the date your business became liable for the tax. For rental

property, report the date the location became taxable as a result of the tenant occupying the unit.

BUSINESS INFORMATION

3. Business Name: business, trade, or fictitious (d/b/a) name.

Business Telephone:

4. Owner Name: legal name of individual, principal partner, or corporation.

Owner Telephone:

5. Business Location: complete physical address of business or real property. Home-based businesses and flea market/craft show

FAX #:

vendors must use their home address. A post office box or rural route number is not acceptable.

City/State/ZIP:

County:

Is business located within city limits?

Yes

No

6. Mail to the Attention of:

Agent’s Telephone:

Address: address where you want us to mail your tax forms and correspondence. If an agent will be receiving the rent, place the agent’s business address in this section.

City/State/ZIP:

County:

Would you like to receive

E-mail address:

Website URL:

correspondence via e-mail?

Yes

No

7.

If you have a Consolidated Sales Tax Number and want to link this business location, please complete the following:

(Does not apply to documentary stamp tax applicants)

8 0

Consolidated registration name on record with the Florida Department of Revenue.

(Consolidated Sales Tax Number)

If you want to obtain a new consolidated number contact the Department and request Form DR-1CON.

8.

Identification Number - If a Federal Employer Identification Number is not required for the entity, the Social Security Number of the owner will

be accepted. This number is required for purposes of identification in order to properly administer the tax laws of Florida. Pursuant to federal

law, this number will not be disclosed to any other party.

FEIN

SSN

If you do not have an FEIN, is it

applied for

not required?

To apply for an FEIN, call the IRS at 1-800-829-1040.

FOR DOR OFFICE USE ONLY

DOR

Office Code

MO QU SA AN SE

SIC

Kind Code

Sales and Use Tax #

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4