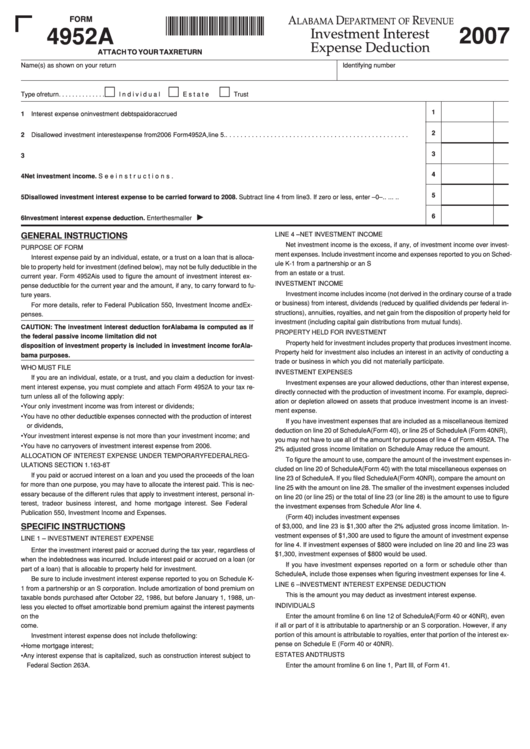

Form 4952a - Investment Interest Expense Deduction - 2007

ADVERTISEMENT

A

D

R

FORM

07000149

LABAMA

EPARTMENT OF

EVENUE

2007

4952A

Investment Interest

Expense Deduction

ATTACH TO YOUR TAX RETURN

Name(s) as shown on your return

Identifying number

Type of return . . . . . . . . . . . . . .

Individual . . . . . . . . . . . . .

Estate . . . . . . . . . . . . . . .

Trust

1

1 Interest expense on investment debts paid or accrued in 2007. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Disallowed investment interest expense from 2006 Form 4952A, line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Total investment interest expense. Add lines 1 and 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Net investment income. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Disallowed investment interest expense to be carried forward to 2008. Subtract line 4 from line 3. If zero or less, enter –0–. . . . . . .

6

6 Investment interest expense deduction. Enter the smaller of line 3 or line 4. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

GENERAL INSTRUCTIONS

LINE 4 – NET INVESTMENT INCOME

Net investment income is the excess, if any, of investment income over invest-

PURPOSE OF FORM

ment expenses. Include investment income and expenses reported to you on Sched-

Interest expense paid by an individual, estate, or a trust on a loan that is alloca-

ule K-1 from a partnership or an S corporation. Also include net investment income

ble to property held for investment (defined below), may not be fully deductible in the

from an estate or a trust.

current year. Form 4952A is used to figure the amount of investment interest ex-

INVESTMENT INCOME

pense deductible for the current year and the amount, if any, to carry forward to fu-

Investment income includes income (not derived in the ordinary course of a trade

ture years.

or business) from interest, dividends (reduced by qualified dividends per federal in-

For more details, refer to Federal Publication 550, Investment Income and Ex-

structions), annuities, royalties, and net gain from the disposition of property held for

penses.

investment (including capital gain distributions from mutual funds).

CAUTION: The investment interest deduction for Alabama is computed as if

PROPERTY HELD FOR INVESTMENT

the federal passive income limitation did not exist. Net capital gain from the

Property held for investment includes property that produces investment income.

disposition of investment property is included in investment income for Ala-

Property held for investment also includes an interest in an activity of conducting a

bama purposes.

trade or business in which you did not materially participate.

WHO MUST FILE

INVESTMENT EXPENSES

If you are an individual, estate, or a trust, and you claim a deduction for invest-

Investment expenses are your allowed deductions, other than interest expense,

ment interest expense, you must complete and attach Form 4952A to your tax re-

directly connected with the production of investment income. For example, depreci-

turn unless all of the following apply:

ation or depletion allowed on assets that produce investment income is an invest-

• Your only investment income was from interest or dividends;

ment expense.

• You have no other deductible expenses connected with the production of interest

If you have investment expenses that are included as a miscellaneous itemized

or dividends,

deduction on line 20 of Schedule A (Form 40), or line 25 of Schedule A (Form 40NR),

• Your investment interest expense is not more than your investment income; and

you may not have to use all of the amount for purposes of line 4 of Form 4952A. The

• You have no carryovers of investment interest expense from 2006.

2% adjusted gross income limitation on Schedule A may reduce the amount.

ALLOCATION OF INTEREST EXPENSE UNDER TEMPORARY FEDERAL REG-

To figure the amount to use, compare the amount of the investment expenses in-

ULATIONS SECTION 1.163-8T

cluded on line 20 of Schedule A (Form 40) with the total miscellaneous expenses on

If you paid or accrued interest on a loan and you used the proceeds of the loan

line 23 of Schedule A. If you filed Schedule A (Form 40NR), compare the amount on

for more than one purpose, you may have to allocate the interest paid. This is nec-

line 25 with the amount on line 28. The smaller of the investment expenses included

essary because of the different rules that apply to investment interest, personal in-

on line 20 (or line 25) or the total of line 23 (or line 28) is the amount to use to figure

terest, trade or business interest, and home mortgage interest. See Federal

the investment expenses from Schedule A for line 4.

Publication 550, Investment Income and Expenses.

Example. Assume line 20 of Schedule A (Form 40) includes investment expenses

SPECIFIC INSTRUCTIONS

of $3,000, and line 23 is $1,300 after the 2% adjusted gross income limitation. In-

vestment expenses of $1,300 are used to figure the amount of investment expense

LINE 1 – INVESTMENT INTEREST EXPENSE

for line 4. If investment expenses of $800 were included on line 20 and line 23 was

Enter the investment interest paid or accrued during the tax year, regardless of

$1,300, investment expenses of $800 would be used.

when the indebtedness was incurred. Include interest paid or accrued on a loan (or

If you have investment expenses reported on a form or schedule other than

part of a loan) that is allocable to property held for investment.

Schedule A, include those expenses when figuring investment expenses for line 4.

Be sure to include investment interest expense reported to you on Schedule K-

LINE 6 – INVESTMENT INTEREST EXPENSE DEDUCTION

1 from a partnership or an S corporation. Include amortization of bond premium on

This is the amount you may deduct as investment interest expense.

taxable bonds purchased after October 22, 1986, but before January 1, 1988, un-

INDIVIDUALS

less you elected to offset amortizable bond premium against the interest payments

on the bond. A taxable bond is a bond on which the interest is includible in gross in-

Enter the amount from line 6 on line 12 of Schedule A (Form 40 or 40NR), even

come.

if all or part of it is attributable to a partnership or an S corporation. However, if any

portion of this amount is attributable to royalties, enter that portion of the interest ex-

Investment interest expense does not include the following:

pense on Schedule E (Form 40 or 40NR).

• Home mortgage interest;

ESTATES AND TRUSTS

• Any interest expense that is capitalized, such as construction interest subject to

Federal Section 263A.

Enter the amount from line 6 on line 1, Part III, of Form 41.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1