Form 4952 - Investment Interest Expense Deduction

ADVERTISEMENT

OMB No. 1545-0191

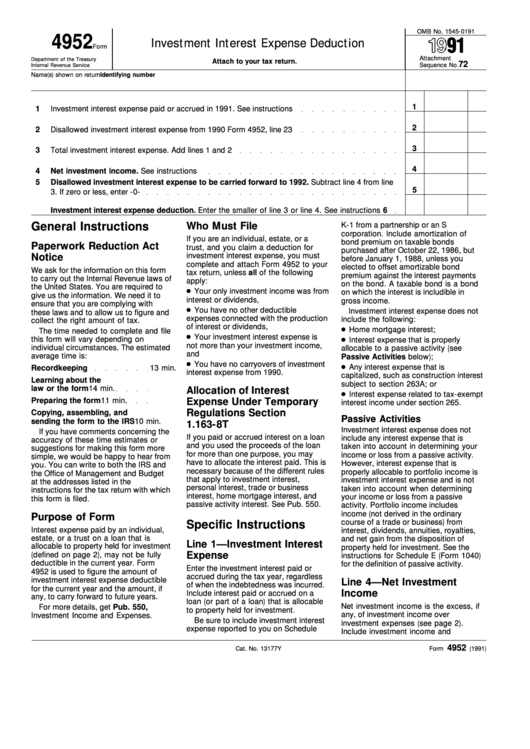

4952

Investment Interest Expense Deduction

Form

Attachment

Department of the Treasury

Attach to your tax return.

72

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

1

1

Investment interest expense paid or accrued in 1991. See instructions

2

2

Disallowed investment interest expense from 1990 Form 4952, line 23

3

3

Total investment interest expense. Add lines 1 and 2

4

4

Net investment income. See instructions

5

Disallowed investment interest expense to be carried forward to 1992. Subtract line 4 from line

5

3. If zero or less, enter -0-

6

Investment interest expense deduction. Enter the smaller of line 3 or line 4. See instructions

6

General Instructions

Who Must File

K-1 from a partnership or an S

corporation. Include amortization of

If you are an individual, estate, or a

bond premium on taxable bonds

Paperwork Reduction Act

trust, and you claim a deduction for

purchased after October 22, 1986, but

investment interest expense, you must

Notice

before January 1, 1988, unless you

complete and attach Form 4952 to your

elected to offset amortizable bond

We ask for the information on this form

tax return, unless all of the following

premium against the interest payments

to carry out the Internal Revenue laws of

apply:

on the bond. A taxable bond is a bond

the United States. You are required to

Your only investment income was from

on which the interest is includible in

give us the information. We need it to

interest or dividends,

gross income.

ensure that you are complying with

You have no other deductible

Investment interest expense does not

these laws and to allow us to figure and

expenses connected with the production

include the following:

collect the right amount of tax.

of interest or dividends,

Home mortgage interest;

The time needed to complete and file

Your investment interest expense is

this form will vary depending on

Interest expense that is properly

not more than your investment income,

individual circumstances. The estimated

allocable to a passive activity (see

and

average time is:

Passive Activities below);

You have no carryovers of investment

Any interest expense that is

Recordkeeping

13 min.

interest expense from 1990.

capitalized, such as construction interest

Learning about the

subject to section 263A; or

law or the form

14 min.

Allocation of Interest

Interest expense related to tax-exempt

Preparing the form

11 min.

Expense Under Temporary

interest income under section 265.

Regulations Section

Copying, assembling, and

Passive Activities

sending the form to the IRS

10 min.

1.163-8T

Investment interest expense does not

If you have comments concerning the

If you paid or accrued interest on a loan

include any interest expense that is

accuracy of these time estimates or

and you used the proceeds of the loan

taken into account in determining your

suggestions for making this form more

for more than one purpose, you may

income or loss from a passive activity.

simple, we would be happy to hear from

have to allocate the interest paid. This is

However, interest expense that is

you. You can write to both the IRS and

necessary because of the different rules

properly allocable to portfolio income is

the Office of Management and Budget

that apply to investment interest,

investment interest expense and is not

at the addresses listed in the

personal interest, trade or business

taken into account when determining

instructions for the tax return with which

interest, home mortgage interest, and

your income or loss from a passive

this form is filed.

passive activity interest. See Pub. 550.

activity. Portfolio income includes

income (not derived in the ordinary

Purpose of Form

course of a trade or business) from

Specific Instructions

Interest expense paid by an individual,

interest, dividends, annuities, royalties,

estate, or a trust on a loan that is

and net gain from the disposition of

Line 1—Investment Interest

allocable to property held for investment

property held for investment. See the

Expense

(defined on page 2), may not be fully

instructions for Schedule E (Form 1040)

deductible in the current year. Form

for the definition of passive activity.

Enter the investment interest paid or

4952 is used to figure the amount of

accrued during the tax year, regardless

investment interest expense deductible

Line 4—Net Investment

of when the indebtedness was incurred.

for the current year and the amount, if

Income

Include interest paid or accrued on a

any, to carry forward to future years.

loan (or part of a loan) that is allocable

Net investment income is the excess, if

For more details, get Pub. 550,

to property held for investment.

any, of investment income over

Investment Income and Expenses.

Be sure to include investment interest

investment expenses (see page 2).

expense reported to you on Schedule

Include investment income and

4952

Cat. No. 13177Y

Form

(1991)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2