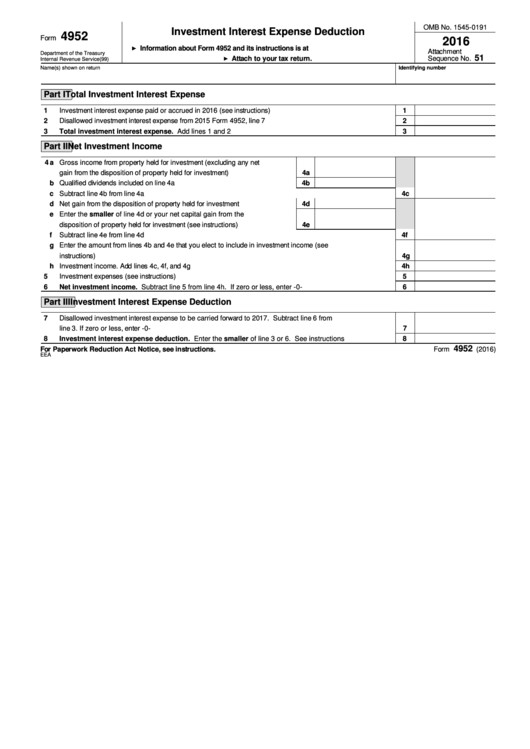

Form 4952 - Investment Interest Expense Deduction - 2016

ADVERTISEMENT

OMB No. 1545-0191

Investment Interest Expense Deduction

4952

Form

2016

Information about Form 4952 and its instructions is at

Attachment

Department of the Treasury

51

Attach to your tax return.

Sequence No.

Internal Revenue Service

(99)

Name(s) shown on return

Identifying number

Part I

Total Investment Interest Expense

. . . . . . . . . . . . . . . . .

1

Investment interest expense paid or accrued in 2016 (see instructions)

1

. . . . . . . . . . . . . . . . . .

2

Disallowed investment interest expense from 2015 Form 4952, line 7

2

. . . . . . . . . . . . . . . . . . . . . . . .

3

Total investment interest expense. Add lines 1 and 2

3

Part II

Net Investment Income

4 a

Gross income from property held for investment (excluding any net

. . . . . . . .

gain from the disposition of property held for investment)

4a

. . . . . . . . . . . . . . . . .

b

Qualified dividends included on line 4a

4b

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c

Subtract line 4b from line 4a

4c

. . . . . .

d

Net gain from the disposition of property held for investment

4d

e

Enter the smaller of line 4d or your net capital gain from the

. . . . . .

disposition of property held for investment (see instructions)

4e

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f

Subtract line 4e from line 4d

4f

g

Enter the amount from lines 4b and 4e that you elect to include in investment income (see

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

instructions)

4g

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

h

Investment income. Add lines 4c, 4f, and 4g

4h

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Investment expenses (see instructions)

5

. . . . . . . . . . . . .

6

Net investment income. Subtract line 5 from line 4h. If zero or less, enter -0-

6

Part III

Investment Interest Expense Deduction

7

Disallowed investment interest expense to be carried forward to 2017. Subtract line 6 from

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

line 3. If zero or less, enter -0-

7

. . . . . .

8

Investment interest expense deduction. Enter the smaller of line 3 or 6. See instructions

8

4952

For Paperwork Reduction Act Notice, see instructions.

Form

(2016)

EEA

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1