Home Business Application Packet - City Of Thornton Sales Tax Division Page 2

ADVERTISEMENT

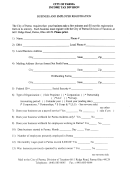

TOTAL NUMBER OF LOCATIONS OPERATED THAT ARE SUBJECT TO CITY SALES OR USE TAX:

If more than one, give preference for filing returns: (check only one):

Separately, each location

Consolidated

ADDITIONAL BUSINESS LOCATIONS / LEASED EQUIPMENT, VENDING MACHINE, OR AMUSEMENT DEVICE LOCATIONS:

Name of Thornton Business Location

Address

No. of machines or pieces of leased

equipment at location

PRIVILEGED AND/OR CONFIDENTIAL COMMERCIAL FINANCIAL INFORMATION

NAMES AND HOME ADDRESSES OF OWNERS, PARTNERS, OFFICERS, OR MEMBERS OF LLC (Must Be Completed)

Name

Date of Birth

Address (street, city, state, zip code)

Phone Number

% owned and title

Bank Name

Bank Account No.

Type of Account

Bank Address

Federal Employer Identification No. (FEIN) or SS#

Colorado State License No.

Drivers License No. (Sole Proprietors Only)

FILING FREQUENCY: If average tax owed is:

$25.00/month or less – Annually

Under $100/month – Quarterly

$100/month or more - Monthly

Wholesale only - Annually

"I declare, under penalty of perjury, that this application has been examined by me and the statements made herein are made in good faith pursuant to the City of Thornton

tax laws and, to the best of my knowledge and belief, are true, correct and complete."

APPLICANT: (PLEASE PRINT)

APPLICANT'S SIGNATURE:

TITLE:

DATE:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4