Home Business Application Packet - City Of Thornton Sales Tax Division Page 3

ADVERTISEMENT

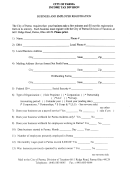

THORNTON INITIAL USE TAX RETURN FOR A NEW BUSINESS

OR ACQUISITION OF AN EXISTING BUSINESS

CITY OF THORNTON, COLORADO

COMPLETE AND RETURN ORIGINAL COPY

SALES TAX DEPARTMENT

MAKE COPY FOR YOUR RECORDS

9500 Civic Center Drive

Thornton, Colorado 80229-4326

THE CITY OF THORNTON SALES AND USE TAX ORDINANCE LEVIES A 3.75% USE TAX UPON:

a) Tangible personal property purchased for use (i.e. items not for resale) in the operation of your business within the corporate limits of

Thornton, when no City sales tax was paid at the time of purchase; and

b) Tangible personal property (except inventory for resale) acquired through the purchase of a "going or existing business" within the corporate

limits of Thornton.

To determine if Thornton's 3.75% use tax is due, examine the Purchase Agreement and/or all invoice copies of tangible

personal property purchased. If the Purchase Agreement and/or invoices do not include 3.75% sales tax for the City of

Thornton, as well as all Colorado State collected sales taxes, then those items should be included on the schedule below.

Some common items subject to the tax are, but not limited to, furniture, fixtures, office equipment, machinery, shelving,

cabinets, preprinted forms, books, factory supplies, office supplies, cleaning supplies, brochures, and leases or rentals of any

equipment. If you have questions on the taxability of specific items, contact the City Sales Tax Department at 303-538-7400.

Please schedule below all tangible personal property brought into the City or purchased and delivered to your new Thornton business location. (If

necessary, attach additional listings and enter the total amount on the "Total Cost" line below.) If you have purchase documents which show that

City tax has been paid attach copies and enter "none" on the "Tax Due" line. In order for this return to be properly reviewed, please enclose

copies of all invoices and/or other supporting documentation.

Purchase Date

Name of Vendor

Description of Item

$ Cost

1

2

3

4

5

6

7

8

9

10

PLEASE NOTE

THIS RETURN MUST BE PROPERLY SIGNED

Total Cost

$

AND RETURNED TOGETHER WITH THE AMOUNT

TAX DUE 3.75% of Total Cost

$

DUE, IF ANY, ON OR BEFORE THE TWENTIETH

(20TH) DAY OF THE MONTH FOLLOWING THE

IF RETURN IS FILED AFTER THE DUE DATE, THEN ADD:

DATE OF PURCHASE.

Penalty: 10% of Tax

$

Interest: .58% per month

$

Total Due:

$

I hereby certify this is a complete list reflecting the total cost of all taxable tangible personal property initially purchased or brought into the City for

use in Thornton by the business named below:

Business Name:

Signature:

Address:

Title:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4