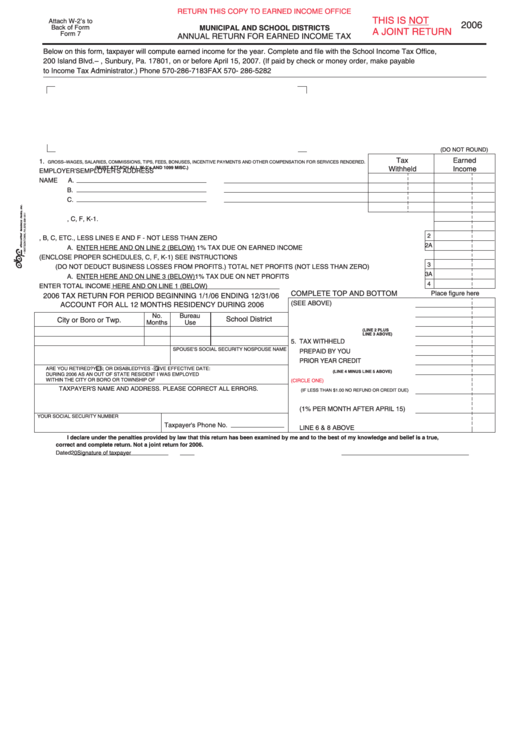

Municipal And School Districts Annual Return For Earned Income Tax - Pennsylvania Department Of Revenue - 2006

ADVERTISEMENT

RETURN THIS COPY TO EARNED INCOME OFFICE

THIS IS NOT

Attach W-2’s to

2006

Back of Form

MUNICIPAL AND SCHOOL DISTRICTS

A JOINT RETURN

Form 7

ANNUAL RETURN FOR EARNED INCOME TAX

Below on this form, taxpayer will compute earned income for the year. Complete and file with the School Income Tax Office,

200 Island Blvd.–P.O. Box 242, Sunbury, Pa. 17801, on or before April 15, 2007. (If paid by check or money order, make payable

to Income Tax Administrator.) Phone 570-286-7183 FAX 570- 286-5282

(DO NOT ROUND)

Tax

Earned

1.

GROSS–WAGES, SALARIES, COMMISSIONS, TIPS, FEES, BONUSES, INCENTIVE PAYMENTS AND OTHER COMPENSATION FOR SERVICES RENDERED.

(MUST ATTACH ALL W-2’s AND 1099 MISC.)

Withheld

Income

EMPLOYER'S

EMPLOYER'S ADDRESS

NAME

A.

B.

C.

D.

TOTAL TAX WITHHELD - ENTER TOTAL ON LINE 5 BELOW.

E. LESS BUSINESS LOSSES. ATTACH APPLICABLE BUSINESS LOSS SCHEDULES, C, F, K-1.

F. LESS UNREIMBURSED EMPLOYEE BUSINESS EXPENSES. ENCLOSE FORM 2106 AND / OR PA. UE FORM

2

2. TOTAL SEC. A GROSS EARNED INCOME. SUM OF LINES 1A, B, C, ETC., LESS LINES E AND F - NOT LESS THAN ZERO

2A

A. ENTER HERE AND ON LINE 2 (BELOW) 1% TAX DUE ON EARNED INCOME

3. NET PROFITS FROM SELF-EMPLOYMENT (ENCLOSE PROPER SCHEDULES, C, F, K-1) SEE INSTRUCTIONS

3

(DO NOT DEDUCT BUSINESS LOSSES FROM PROFITS.) TOTAL NET PROFITS (NOT LESS THAN ZERO)

3A

A. ENTER HERE AND ON LINE 3 (BELOW)

1% TAX DUE ON NET PROFITS

4

4. ADD LINES 2 AND 3. ENTER TOTAL INCOME HERE AND ON LINE 1 (BELOW)

COMPLETE TOP AND BOTTOM

Place figure here

2006 TAX RETURN FOR PERIOD BEGINNING 1/1/06 ENDING 12/31/06

1. INCOME FROM LINE 4 (SEE ABOVE)

ACCOUNT FOR ALL 12 MONTHS RESIDENCY DURING 2006

2. TAX DUE ON EARNED INCOME.

No.

Bureau

School District

City or Boro or Twp.

Months

Use

3. TAX DUE ON NET PROFITS.

(LINE 2 PLUS

4. TOTAL TAXES DUE.

LINE 3 ABOVE)

5. TAX WITHHELD

SPOUSE NAME

SPOUSE'S SOCIAL SECURITY NO

PREPAID BY YOU

PRIOR YEAR CREDIT

ARE YOU RETIRED?

YES; OR DISABLED?

YES - GIVE EFFECTIVE DATE:

6. TAX DUE.

(LINE 4 MINUS LINE 5 ABOVE)

DURING 2006 AS AN OUT OF STATE RESIDENT I WAS EMPLOYED

7. REFUND OR CREDIT DUE.

WITHIN THE CITY OR BORO OR TOWNSHIP OF

(CIRCLE ONE)

TAXPAYER'S NAME AND ADDRESS. PLEASE CORRECT ALL ERRORS.

(IF LESS THAN $1.00 NO REFUND OR CREDIT DUE)

8. INTEREST AND PENALTY.

(1% PER MONTH AFTER APRIL 15)

YOUR SOCIAL SECURITY NUMBER

9. TOTAL PAID WITH THIS RETURN.

Taxpayer's Phone No.

LINE 6 & 8 ABOVE

I declare under the penalties provided by law that this return has been examined by me and to the best of my knowledge and belief is a true,

correct and complete return. Not a joint return for 2006.

Dated

20

Signature of taxpayer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2