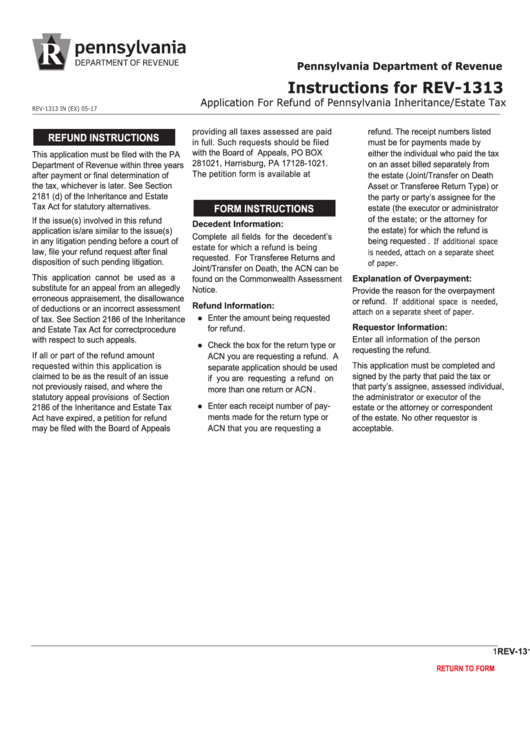

Instructions For Rev-1313 - Application For Refund Of Pennsylvania Inheritance/estate Tax - Pennsylvania Department Of Revenue

ADVERTISEMENT

Pennsylvania Department of Revenue

Instructions for REV-1313

Application for Refund of Pennsylvania Inheritance/Estate Tax

REV-1313 IN (Ex) 05-17

providing all taxes assessed are paid

refund. The receipt numbers listed

REFUND INSTRUCTIONS

in full. Such requests should be filed

must be for payments made by

with the Board of Appeals, PO BOX

either the individual who paid the tax

This application must be filed with the PA

281021, Harrisburg, PA 17128-1021.

on an asset billed separately from

Department of Revenue within three years

The petition form is available at

after payment or final determination of

the estate (Joint/Transfer on Death

the tax, whichever is later. See Section

Asset or Transferee Return Type) or

2181 (d) of the Inheritance and Estate

the party or party’s assignee for the

FORM INSTRUCTIONS

Tax Act for statutory alternatives.

estate (the executor or administrator

of the estate; or the attorney for

If the issue(s) involved in this refund

Decedent Information:

the estate) for which the refund is

application is/are similar to the issue(s)

Complete all fields for the decedent’s

in any litigation pending before a court of

being requested.

estate for which a refund is being

If additional space

law, file your refund request after final

requested. For Transferee Returns and

disposition of such pending litigation.

is needed, attach on a separate sheet

Joint/Transfer on Death, the ACN can be

of paper.

This application cannot be used as a

Explanation of Overpayment:

found on the Commonwealth Assessment

substitute for an appeal from an allegedly

Notice.

Provide the reason for the overpayment

erroneous appraisement, the disallowance

or refund.

Refund Information:

of deductions or an incorrect assessment

If additional space is needed,

● Enter the amount being requested

of tax. See Section 2186 of the Inheritance

attach on a separate sheet of paper.

Requestor Information:

for refund.

and Estate Tax Act for correct procedure

Enter all information of the person

with respect to such appeals.

● Check the box for the return type or

requesting the refund.

If all or part of the refund amount

ACN you are requesting a refund. A

requested within this application is

This application must be completed and

separate application should be used

claimed to be as the result of an issue

signed by the party that paid the tax or

if you are requesting a refund on

not previously raised, and where the

that party’s assignee, assessed individual,

more than one return or ACN.

statutory appeal provisions of Section

the administrator or executor of the

● Enter each receipt number of pay-

estate or the attorney or correspondent

2186 of the Inheritance and Estate Tax

ments made for the return type or

Act have expired, a petition for refund

of the estate. No other requestor is

may be filed with the Board of Appeals

ACN that you are requesting a

acceptable.

www revenue pa gov

REV-1313

1

RETURN TO FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1