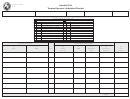

Schedules 1 Through 4 - Schedule Of Receipts - Indiana Department Of Revenue Page 2

ADVERTISEMENT

Instructions for Completing

Schedule of Receipts

Schedules 1 - 4

Before you begin:

These schedules provide detail in support of the amount(s) shown as receipts on the Consolidated Special Fuel Monthly Tax Return, Form

SF-900, and Consolidated Gasoline Monthly Tax Return, Form MF-360. Enter your identifying information as it is reflected on your Indiana

Fuel Tax License. Be certain to check the appropriate schedule type that you are completing as well as the product type. Complete a

separate schedule for each fuel product type. If product type “Other” is specified, please name specific fuel type.

Schedule Type:

Indicate the appropriate schedule type you are completing:

1

Gallons Received , Tax Paid, (Special Fuel Returns Only)

1 A

Gallons Received, Tax Paid (Gasoline Return Only)

2

Gallons Received from Licensed Distributor or Oil Inspection Distributor, Tax Unpaid (Gasoline Only)

2 E

Gallons Received for Export (Licensed Special Fuel Exporters Only)

2 K

Gallons of Non-Taxable Fuel Received and Sold or Used for a Taxable Purpose

2 X

Gallons Received from Distributor on Exchange (Gasoline Only)

3

Gallons Imported Via Truck, Barge or Rail, Tax Unpaid

4

Gallons Imported into Own Storage (Gasoline Only)

Column Instructions:

Columns 1 and 2: Enter the name and Federal Employer’s Identification Number (FEIN) of the company that transports the fuel.

This may or may not be your company.

Column 3: Enter the mode of transport. One of the following codes should be used for each entry.

J

= Truck

P L

= Pipeline

R

= Rail

B

= Barge

ST = Stock Transfer

BA

= Book Adjustment

S

= Ship (Great Lakes or Ocean Marine Vessel)

Column 4: Enter the point of origin and destination state.

Columns 5-8: Enter the seller’s name and Federal Identification Number (FEIN), the date of receipt and the document

number. Invoice numbers cannot be used in lieu of bill of lading or manifest numbers.

Column 9: Enter the net gallons.

Column 10: Enter the gross gallons.

Column 11: Enter the billed (invoiced) gallons, which should equal either the net or the gross gallons.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2