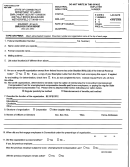

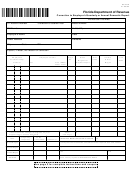

Form Usc-1i - Instructions For Preparing Form Ucs-1 Employer Registration Report - Florida Department Of Revenue

ADVERTISEMENT

USC-1I

R. 10/00

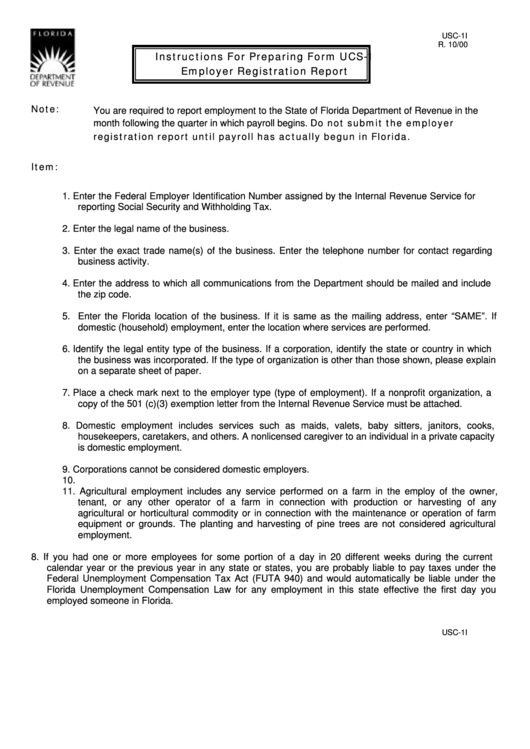

Instructions For Preparing Form UCS-1

Employer Registration Report

Note:

You are required to report employment to the State of Florida Department of Revenue in the

month following the quarter in which payroll begins. Do not submit the employer

registration report until payroll has actually begun in Florida.

Item:

1.

Enter the Federal Employer Identification Number assigned by the Internal Revenue Service for

reporting Social Security and Withholding Tax.

2. Enter the legal name of the business.

3. Enter the exact trade name(s) of the business. Enter the telephone number for contact regarding

business activity.

4. Enter the address to which all communications from the Department should be mailed and include

the zip code.

5. Enter the Florida location of the business. If it is same as the mailing address, enter “SAME”. If

domestic (household) employment, enter the location where services are performed.

6. Identify the legal entity type of the business. If a corporation, identify the state or country in which

the business was incorporated. If the type of organization is other than those shown, please explain

on a separate sheet of paper.

7. Place a check mark next to the employer type (type of employment). If a nonprofit organization, a

copy of the 501 (c)(3) exemption letter from the Internal Revenue Service must be attached.

8. Domestic employment includes services such as maids, valets, baby sitters, janitors, cooks,

housekeepers, caretakers, and others. A nonlicensed caregiver to an individual in a private capacity

is domestic employment.

9. Corporations cannot be considered domestic employers.

10.

11. Agricultural employment includes any service performed on a farm in the employ of the owner,

tenant, or any other operator of a farm in connection with production or harvesting of any

agricultural or horticultural commodity or in connection with the maintenance or operation of farm

equipment or grounds. The planting and harvesting of pine trees are not considered agricultural

employment.

8. If you had one or more employees for some portion of a day in 20 different weeks during the current

calendar year or the previous year in any state or states, you are probably liable to pay taxes under the

Federal Unemployment Compensation Tax Act (FUTA 940) and would automatically be liable under the

Florida Unemployment Compensation Law for any employment in this state effective the first day you

employed someone in Florida.

USC-1I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2