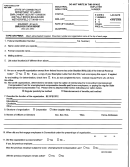

Form Usc-1i - Instructions For Preparing Form Ucs-1 Employer Registration Report - Florida Department Of Revenue Page 2

ADVERTISEMENT

R. 10/00

9. Enter the date you first employed any person in Florida . If you previously reported to Florida, please use

the date your business resumed. Enter any previous account numbers used on the line provided in the

upper right corner on the Employer Registration Report.

10. A self-employed worker is not subject to the will and control of the employer. The employer does not

control or direct the manner or method of job performance. Determinations on this type of worker are made

on a case-by-case basis.

11. Check “YES” if you wish to voluntarily elect to cover your employees and you feel that you are not

otherwise subject to the law.

12. A. Provide full name, title, social security number, home address, and home telephone number for each

appropriate individual. Do not use business addresses or telephone numbers.

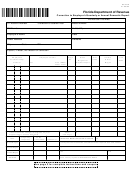

B. Give name, address, and telephone number of accountant, bookkeeper, or tax service.

13. List each establishment or place of business in Florida by location worksite, and give the description of the

type of service performed, products made, products sold, etc. If there is no business location in Florida, list

the city in Florida in which employees reside or where work is taking place. Include nature of firm’s

business as well as nature of business conducted in Florida, if different. A separate line should also be

used to list more than one location of the same type of business. Use a separate sheet of paper, if needed.

14. Indicate whether the worksite(s) provide support for any other units of the company. If you acquired all or

any portion of the organization, assets, or trade of an existing business, complete this item. Includes

changes in type of ownership such as sole proprietor to corporation, corporation to sole proprietor, sole

proprietor to partnership, a change in partners, etc.

15. Employment of one or more individuals for any portion of a day during a given week constitutes one week

of employment. Include corporate activity.

16. Quarterly gross payroll must include all remuneration for employment including commissions, bonuses,

back pay awards, and the cash value of all remuneration paid in any medium other than cash.

Internet Address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2