Private Education Loan - Smart Option Student Loan - Application And Solicitation Disclosure - Variable Rate Type

ADVERTISEMENT

06/26/2017

Rev #: 01

Private Education Loan - Smart Option Student Loan

Application and Solicitation Disclosure

Variable Rate Type (see pages 3 & 4 for Fixed Rate Type)

Sallie Mae Bank

P.O. Box 3319

Wilmington, DE 19804

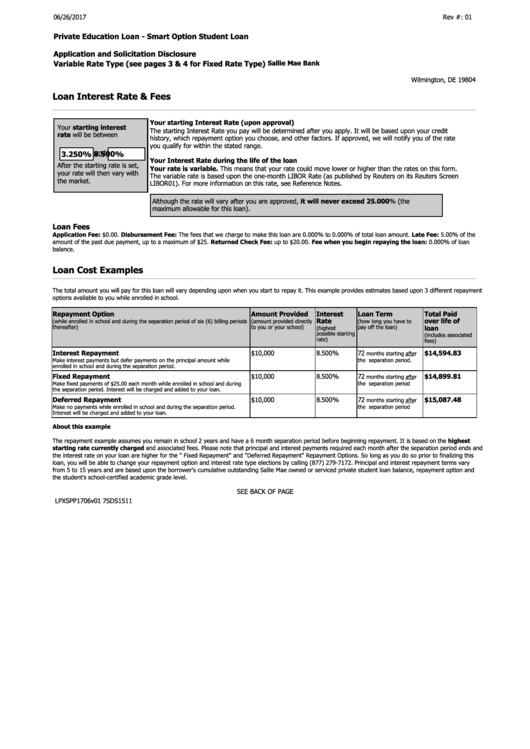

Loan Interest Rate & Fees

Your starting Interest Rate (upon approval)

Your starting interest

The starting Interest Rate you pay will be determined after you apply. It will be based upon your credit

rate will be between

history, which repayment option you choose, and other factors. If approved, we will notify you of the rate

you qualify for within the stated range.

and

8.500 %

3.250%

Your Interest Rate during the life of the loan

After the starting rate is set,

Your rate is variable. This means that your rate could move lower or higher than the rates on this form.

your rate will then vary with

The variable rate is based upon the one-month LIBOR Rate (as published by Reuters on its Reuters Screen

the market.

LIBOR01). For more information on this rate, see Reference Notes.

Although the rate will vary after you are approved, it will never exceed 25.000% (the

maximum allowable for this loan).

Loan Fees

Application Fee: $0.00. Disbursement Fee: The fees that we charge to make this loan are 0.000% to 0.000% of total loan amount. Late Fee: 5.00% of the

amount of the past due payment, up to a maximum of $25. Returned Check Fee: up to $20.00. Fee when you begin repaying the loan: 0.000% of loan

balance.

Loan Cost Examples

The total amount you will pay for this loan will vary depending upon when you start to repay it. This example provides estimates based upon 3 different repayment

options available to you while enrolled in school.

Repayment Option

Amount Provided

Interest

Loan Term

Total

Paid

Rate

over life of

(while enrolled in school and during the separation period of six (6) billing periods

(amount provided directly

(how long you have to

thereafter)

to you or your school)

pay off the loan)

(highest

loan

possible starting

(includes associated

rate)

fees)

Interest Repayment

$10,000

8.500%

72

$14,594.83

months starting after

the separation period.

Make interest payments but defer payments on the principal amount while

enrolled in school and during the separation period.

Fixed Repayment

$10,000

8.500%

72

$14,899.81

months starting after

the separation period

Make fixed payments of $25.00 each month while enrolled in school and during

the separation period. Interest will be charged and added to your loan.

Deferred Repayment

$10,000

8.500%

72

$15,087.48

months starting after

the separation period

Make no payments while enrolled in school and during the separation period.

Interest will be charged and added to your loan.

About this example

The repayment example assumes you remain in school 2 years and have a 6 month separation period before beginning repayment. It is based on the highest

starting rate currently charged and associated fees. Please note that principal and interest payments required each month after the separation period ends and

the interest rate on your loan are higher for the " Fixed Repayment" and "Deferred Repayment" Repayment Options. So long as you do so prior to finalizing this

loan, you will be able to change your repayment option and interest rate type elections by calling (877) 279-7172. Principal and interest repayment terms vary

from 5 to 15 years and are based upon the borrower's cumulative outstanding Sallie Mae owned or serviced private student loan balance, repayment option and

the student's school-certified academic grade level.

SEE BACK OF PAGE

LPXSPP1706v01

7SDS1511

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4