Private Education Loan - Smart Option Student Loan - Application And Solicitation Disclosure - Variable Rate Type Page 4

ADVERTISEMENT

06/26/2017

Rev #: 01

Federal Loan Alternatives

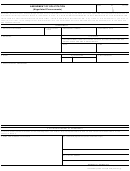

Loan Program

Current Interest Rates by Program Type*

PERKINS

5.000% fixed

for Students

You may qualify for Federal education

loans.

4.450% fixed Undergraduate subsidized and

STAFFORD

For additional information, contact your

unsubsidized

for Students

school's financial aid office or the

6.000% fixed Graduate

Department of Education at:

PLUS

7.000% fixed Federal Direct Loan

for Parents and

Graduate/Professional

Students

*These interest rates are determined by federal law and are fixed for the life of the loan. The federal loan interest rates may change in the future, but only for new federal loans. Federal law may

also change in the future. To learn more, go to:

Next Steps

1. Find Out About Other Loan Options.

Some schools have school-specific student loan benefits and terms not detailed on this form. Contact your school's financial aid office or visit the

Department of Education's website at: for more information about other loans.

2. To Apply for this Loan, Complete the Application and the Self-Certification Form.

You may get the certification form from your school's financial aid office. If you are approved for this loan, the loan terms will be available for 30 days (terms

will not change during this period, except as permitted by law).

REFERENCE NOTES

Fixed Interest Rate

This loan has a fixed interest rate and will not increase or decrease for the life of the loan.

Eligibility Criteria

Borrower

You must attend an eligible school, be an undergraduate student, or attending an eligible associate, bachelors, graduate or technical/trade program at least half-time. In

some circumstances, the Smart Option Student Loan is available to less-than-half-time students and students enrolled in a c ontinuing education program.

Must have attained the age of majority in your state of residence at the time of loan application. Otherwise a cosigner is re quired.

Cosigner

A cosigner is not required for U.S. citizens and permanent residents, but may help you qualify and/or receive a lower interest rate.

Must have attained the age of majority in their state of residence at the time of loan application.

Bankruptcy Limitations

If you file for bankruptcy you may still be required to pay back this loan.

More information about loan eligibility and repayment deferral or forbearance options is available in your loan application and Promissory Note.

LPXSPP1706v01

7SDS1511

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4