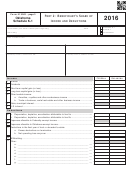

Form 513NR -

page 3

2016

Part 2: Beneficiary’s Share of

Oklahoma

Income and Deductions

Schedule K-1

Amended K-1

For calendar year 2016 or fiscal year beginning ________________________________, 2016

Final K-1

and ending ________________________________________________________ , _________.

Nonresident

Name of estate or trust

Beneficiary’s FEIN/SSN

Estate’s or trust’s Federal Employer Identification Number

Beneficiary’s name, address and ZIP

Fiduciary’s name, address and ZIP

Income

Federal

Oklahoma

Interest ......................................................................................................................

1

1

Dividends ....................................................................................................................

2

2

Short-term capital gain (or loss) .................................................................................

3

3

Long-term capital gain (or loss) ..................................................................................

4

4

Other taxable income:

5

a. Annuities, royalties and other nonbusiness income .....................................

5a

b. Trade or business, rental real estate and other business income ................

5b

State, municipal interest .............................................................................................

6

6

U.S. interest ................................................................................................................

7

7

Deductions

a. Depreciation, depletion, amortization attributable to line 5a ...............................

8

8a

b. Depreciation, depletion, amortization attributable to line 5b ...............................

8b

9

Expenses allocable to Federally-exempt income .......................................................

9

Expenses allocable to Oklahoma-exempt income.....................................................

10

10

Deductions in the final year of trust or decedent’s estate:

11

a. Excess deductions on termination ..............................................................

11a

b. Net operating loss carryover ......................................................................

11b

12

Withholding ................................................................................................................

12

13

Other:

a. __________________________________________________________

13a

b. __________________________________________________________

13b

c. __________________________________________________________

13c

d. __________________________________________________________

13d

e. __________________________________________________________

13e

f. __________________________________________________________

13 f

g. __________________________________________________________

13g

1

1 2

2 3

3 4

4