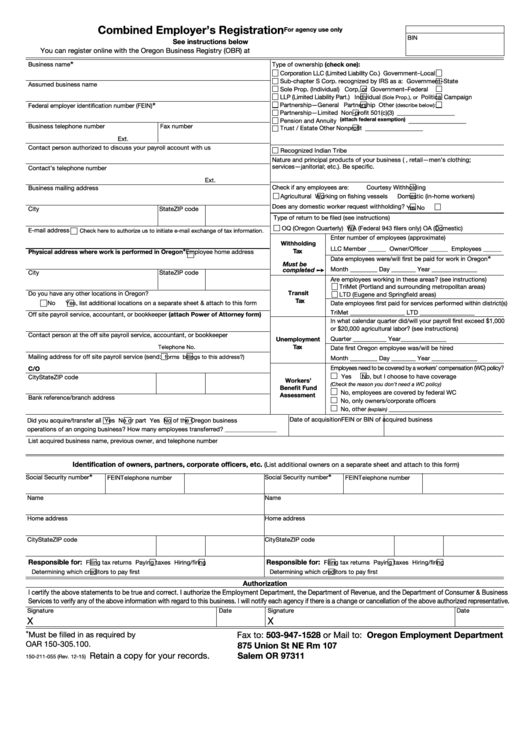

Clear Form

Combined Employer’s Registration

For agency use only

BIN

See instructions below

You can register online with the Oregon Business Registry (OBR) at https://secure.sos.state.or.us/cbrmanager/

*

Business name

Type of ownership (check one):

Corporation

LLC (Limited Liability Co.)

Government–Local

Sub-chapter S Corp.

recognized by IRS as a:

Government–State

Assumed business name

Sole Prop. (Individual)

Corp, or

Government–Federal

LLP (Limited Liability Part.)

Individual

Political Campaign

(Sole Prop.), or

*

Partnership—General

Partnership

Other

Federal employer identification number (FEIN)

(describe below):

Partnership—Limited

Non-profit 501(c)(3)

___________________

(attach federal exemption)

Pension and Annuity

___________________

Business telephone number

Fax number

Trust / Estate

Other Nonprofit

___________________

Ext.

Contact person authorized to discuss your payroll account with us

Recognized Indian Tribe

Nature and principal products of your business (i.e., retail—men’s clothing;

services—janitorial; etc.). Be specific.

Contact’s telephone number

Ext.

Check if any employees are:

Courtesy Withholding

Business mailing address

Agricultural

Working on fishing vessels

Domestic (in-home workers)

Does any domestic worker request withholding?

Yes

No

City

State

ZIP code

Type of return to be filed (see instructions)

OQ (Oregon Quarterly)

WA (Federal 943 filers only)

OA (Domestic)

E-mail address

Check here to authorize us to initiate e-mail exchange of tax information.

Enter number of employees (approximate)

Withholding

LLC Member ______ Owner/Officer ______ Employees ______

Tax

*

Physical address where work is performed in Oregon

Employee home address

*

Date employees were/will first be paid for work in Oregon

Must be

Month _________ Day ________ Year _______________

completed

➙

City

State

ZIP code

Are employees working in these areas? (see instructions)

TriMet (Portland and surrounding metropolitan areas)

Transit

Do you have any other locations in Oregon?

LTD (Eugene and Springfield areas)

Tax

Date employees first paid for services performed within district(s)

No

Yes, list additional locations on a separate sheet & attach to this form

TriMet __________________ LTD __________________

Off site payroll service, accountant, or bookkeeper (attach Power of Attorney form)

In what calendar quarter did/will your payroll first exceed $1,000

or $20,000 agricultural labor? (see instructions)

Contact person at the off site payroll service, accountant, or bookkeeper

Quarter ___________ Year_______________

Unemployment

Tax

Telephone No.

Date first Oregon employee was/will be hired

Mailing address for off site payroll service (send:

forms

billings to this address?)

Month _________ Day ________ Year _______________

Employees need to be covered by a workers’ compensation (WC) policy?

C/O

Yes

No, but I choose to have coverage

City

State

ZIP code

Workers’

(Check the reason you don’t need a WC policy)

Benefit Fund

No, employees are covered by federal WC

Assessment

Bank reference/branch address

No, only owners/corporate officers

No, other

_______________________________________

(explain)

Date of acquisition

FEIN or BIN of acquired business

Did you acquire/transfer all

Yes

No or part

Yes

No of the Oregon business

operations of an ongoing business? How many employees transferred? _________________

List acquired business name, previous owner, and telephone number

Identification of owners, partners, corporate officers, etc.

(List additional owners on a separate sheet and attach to this form)

*

*

Social Security number

Social Security number

FEIN

Telephone number

FEIN

Telephone number

Name

Name

Home address

Home address

City

State

ZIP code

City

State

ZIP code

Responsible for:

Responsible for:

Filing tax returns

Paying taxes

Hiring/firing

Filing tax returns

Paying taxes

Hiring/firing

Determining which creditors to pay first

Determining which creditors to pay first

Authorization

I certify the above statements to be true and correct. I authorize the Employment Department, the Department of Revenue, and the Department of Consumer & Business

Services to verify any of the above information with regard to this business. I will notify each agency if there is a change or cancellation of the above authorized representative.

Signature

Date

Signature

Date

X

X

* Must be filled in as required by

Fax to: 503-947-1528 or Mail to: Oregon Employment Department

OAR 150-305.100.

875 Union St NE Rm 107

Salem OR 97311

Retain a copy for your records.

150-211-055 (Rev. 12-15)

1

1