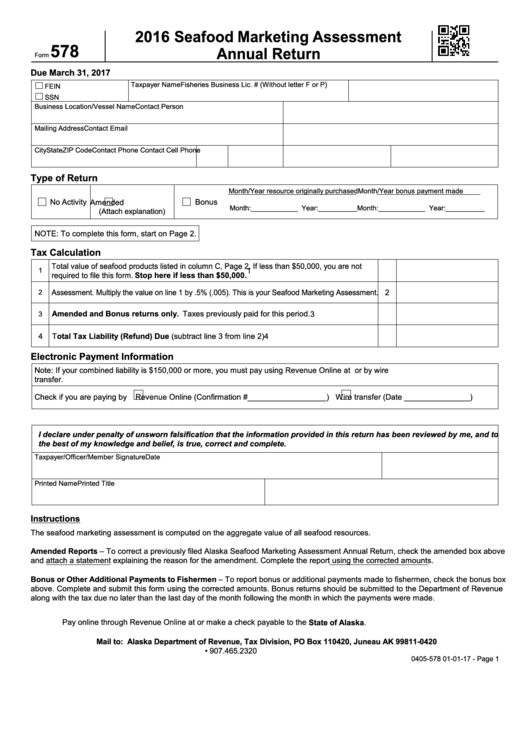

Form 578 - Seafood Marketing Assessment Annual Return - 2016

ADVERTISEMENT

2016 Seafood Marketing Assessment

578

Annual Return

Form

Due March 31, 2017

Taxpayer Name

Fisheries Business Lic. # (Without letter F or P)

FEIN

SSN

Business Location/Vessel Name

Contact Person

Mailing Address

Contact Email

City

State

ZIP Code

Contact Phone

Contact Cell Phone

Type of Return

Month/Year resource originally purchased

Month/Year bonus payment made

No Activity

Amended

Bonus

Month:____________ Year:__________

Month:____________ Year:__________

(Attach explanation)

NOTE: To complete this form, start on Page 2.

Tax Calculation

Total value of seafood products listed in column C, Page 2. If less than $50,000, you are not

1

1

required to file this form. Stop here if less than $50,000.

Assessment. Multiply the value on line 1 by .5% (.005). This is your Seafood Marketing Assessment.

2

2

Amended and Bonus returns only. Taxes previously paid for this period.

3

3

4

Total Tax Liability (Refund) Due (subtract line 3 from line 2)

4

Electronic Payment Information

Note: If your combined liability is $150,000 or more, you must pay using Revenue Online at or by wire

transfer.

Check if you are paying by

Revenue Online (Confirmation #__________________)

Wire transfer (Date _______________)

I declare under penalty of unsworn falsification that the information provided in this return has been reviewed by me, and to

the best of my knowledge and belief, is true, correct and complete.

Taxpayer/Officer/Member Signature

Date

Printed Name

Printed Title

Instructions

The seafood marketing assessment is computed on the aggregate value of all seafood resources.

Amended Reports – To correct a previously filed Alaska Seafood Marketing Assessment Annual Return, check the amended box above

and attach a statement explaining the reason for the amendment. Complete the report using the corrected amounts.

Bonus or Other Additional Payments to Fishermen – To report bonus or additional payments made to fishermen, check the bonus box

above. Complete and submit this form using the corrected amounts. Bonus returns should be submitted to the Department of Revenue

along with the tax due no later than the last day of the month following the month in which the payments were made.

Pay online through Revenue Online at or make a check payable to the State of Alaska.

Mail to: Alaska Department of Revenue, Tax Division, PO Box 110420, Juneau AK 99811-0420

• 907.465.2320

0405-578 01-01-17 - Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2