Form Op-383 - Rental Surcharge Annual Report - 2016

ADVERTISEMENT

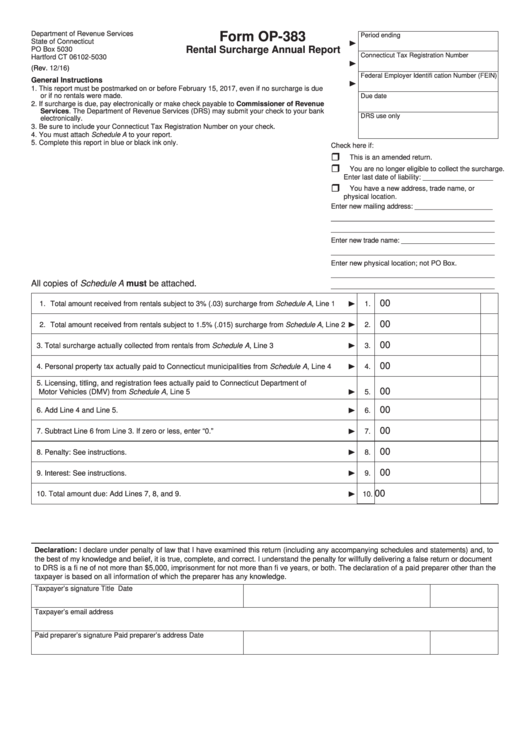

Department of Revenue Services

Form OP-383

Period ending

State of Connecticut

Rental Surcharge Annual Report

PO Box 5030

Connecticut Tax Registration Number

Hartford CT 06102-5030

(Rev. 12/16)

Federal Employer Identifi cation Number (FEIN)

General Instructions

1. This report must be postmarked on or before February 15, 2017, even if no surcharge is due

or if no rentals were made.

Due date

2. If surcharge is due, pay electronically or make check payable to Commissioner of Revenue

Services. The Department of Revenue Services (DRS) may submit your check to your bank

DRS use only

electronically.

3. Be sure to include your Connecticut Tax Registration Number on your check.

4. You must attach Schedule A to your report.

5. Complete this report in blue or black ink only.

Check here if:

This is an amended return.

You are no longer eligible to collect the surcharge.

Enter last date of liability: __________________

You have a new address, trade name, or

physical location.

Enter new mailing address: ____________________

__________________________________________

__________________________________________

Enter new trade name: ________________________

__________________________________________

Enter new physical location; not PO Box.

__________________________________________

All copies of Schedule A must be attached.

__________________________________________

00

1. Total amount received from rentals subject to 3% (.03) surcharge from Schedule A, Line 1

1.

00

2. Total amount received from rentals subject to 1.5% (.015) surcharge from Schedule A, Line 2

2.

00

3. Total surcharge actually collected from rentals from Schedule A, Line 3

3.

00

4. Personal property tax actually paid to Connecticut municipalities from Schedule A, Line 4

4.

5. Licensing, titling, and registration fees actually paid to Connecticut Department of

00

Motor Vehicles (DMV) from Schedule A, Line 5

5.

00

6. Add Line 4 and Line 5.

6.

00

7. Subtract Line 6 from Line 3. If zero or less, enter “0.”

7.

00

8. Penalty: See instructions.

8.

00

9. Interest: See instructions.

9.

10.

00

10. Total amount due: Add Lines 7, 8, and 9.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to

the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document

to DRS is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the

taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer’s signature

Title

Date

Taxpayer’s email address

Paid preparer’s signature

Paid preparer’s address

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4