Local Earned Income Tax Return Form - Berkheimer

ADVERTISEMENT

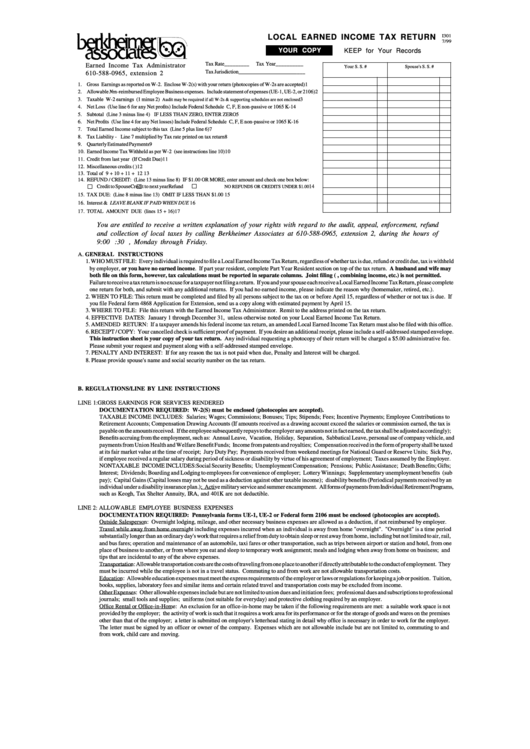

LOCAL EARNED INCOME TAX RETURN

I301

7/99

YOUR COPY

KEEP for Your Records

Tax Rate _________

Tax Year __________

Earned Income Tax Administrator

Your S. S. #

Spouse's S. S. #

Tax Jurisdiction ________________________

610-588-0965, extension 2

1. Gross Earnings as reported on W-2. Enclose W-2(s) with your return (photocopies of W-2s are accepted) ...... 1

2. Allowable Non-reimbursed Employee Business expenses. Include statement of expenses (UE-1, UE-2, or 2106) 2

3. Taxable W-2 earnings (1 minus 2)

............ 3

Audit may be required if all W-2s & supporting schedules are not enclosed

4. Net Loss (Use line 6 for any Net profits) Include Federal Schedule C, F, E non-passive or 1065 K-1 ............... 4

5. Subtotal (Line 3 minus line 4) IF LESS THAN ZERO, ENTER ZERO ............................................................ 5

6. Net Profits (Use line 4 for any Net losses) Include Federal Schedule C, F, E non-passive or 1065 K-1 ............. 6

7. Total Earned Income subject to this tax (Line 5 plus line 6) ................................................................................. 7

8. Tax Liability - Line 7 multiplied by Tax rate printed on tax return ..................................................................... 8

9. Quarterly Estimated Payments ................................................................................................................................ 9

10. Earned Income Tax Withheld as per W-2 (see instructions line 10) ..................................................................... 10

11. Credit from last year (If Credit Due) ...................................................................................................................... 11

12. Miscellaneous credits (i.e. Philadelphia Tax or Out-of-State Tax Credit - see reverse) ......................................... 12

13. Total of 9 + 10 + 11 + 12 ...................................................................................................................................... 13

14. REFUND / CREDIT: (Line 13 minus line 8) IF $1.00 OR MORE, enter amount and check one box below:

Credit to Spouse

Credit to next year

Refund

14

NO REFUNDS OR CREDITS UNDER $1.00

15. TAX DUE: (Line 8 minus line 13) OMIT IF LESS THAN $1.00 ...................................................................... 15

16. Interest & Penalties... LEAVE BLANK IF PAID WHEN DUE ................................................................................ 16

17. TOTAL AMOUNT DUE (lines 15 + 16) ............................................................................................................ 17

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund

and collection of local taxes by calling Berkheimer Associates at 610-588-0965, extension 2, during the hours of

9:00 a.m. through 4:30 p.m., Monday through Friday.

A. GENERAL INSTRUCTIONS

1. WHO MUST FILE: Every individual is required to file a Local Earned Income Tax Return, regardless of whether tax is due, refund or credit due, tax is withheld

by employer, or you have no earned income. If part year resident, complete Part Year Resident section on top of the tax return. A husband and wife may

both file on this form, however, tax calculations must be reported in separate columns. Joint filing (i.e., combining income, etc.) is not permitted.

Failure to receive a tax return is no excuse for a taxpayer not filing a return. If you and your spouse each receive a Local Earned Income Tax Return, please complete

one return for both, and submit with any additional returns. If you had no earned income, please indicate the reason why (homemaker, retired, etc.).

2. WHEN TO FILE: This return must be completed and filed by all persons subject to the tax on or before April 15, regardless of whether or not tax is due. If

you file Federal form 4868 Application for Extension, send us a copy along with estimated payment by April 15.

3. WHERE TO FILE: File this return with the Earned Income Tax Administrator. Remit to the address printed on the tax return.

4. EFFECTIVE DATES: January 1 through December 31, unless otherwise noted on your Local Earned Income Tax Return.

5. AMENDED RETURN: If a taxpayer amends his federal income tax return, an amended Local Earned Income Tax Return must also be filed with this office.

6. RECEIPT / COPY: Your cancelled check is sufficient proof of payment. If you desire an additional receipt, please include a self-addressed stamped envelope.

This instruction sheet is your copy of your tax return. Any individual requesting a photocopy of their return will be charged a $5.00 administrative fee.

Please submit your request and payment along with a self-addressed stamped envelope.

7. PENALTY AND INTEREST: If for any reason the tax is not paid when due, Penalty and Interest will be charged.

8. Please provide spouse's name and social security number on the tax return.

B. REGULATIONS/LINE BY LINE INSTRUCTIONS

LINE 1:GROSS EARNINGS FOR SERVICES RENDERED

DOCUMENTATION REQUIRED: W-2(S) must be enclosed (photocopies are accepted).

TAXABLE INCOME INCLUDES: Salaries; Wages; Commissions; Bonuses; Tips; Stipends; Fees; Incentive Payments; Employee Contributions to

Retirement Accounts; Compensation Drawing Accounts (If amounts received as a drawing account exceed the salaries or commission earned, the tax is

payable on the amounts received. If the employee subsequently repays to the employer any amounts not in fact earned, the tax shall be adjusted accordingly);

Benefits accruing from the employment, such as: Annual Leave, Vacation, Holiday, Separation, Sabbatical Leave, personal use of company vehicle, and

payments from Union Health and Welfare Benefit Funds; Income from patents and royalties; Compensation received in the form of property shall be taxed

at its fair market value at the time of receipt; Jury Duty Pay; Payments received from weekend meetings for National Guard or Reserve Units; Sick Pay,

if employee received a regular salary during period of sickness or disability by virtue of his agreement of employment; Taxes assumed by the Employer.

NONTAXABLE INCOME INCLUDES: Social Security Benefits; Unemployment Compensation; Pensions; Public Assistance; Death Benefits; Gifts;

Interest; Dividends; Boarding and Lodging to employees for convenience of employer; Lottery Winnings; Supplementary unemployment benefits (sub

pay); Capital Gains (Capital losses may not be used as a deduction against other taxable income); disability benefits (Periodical payments received by an

individual under a disability insurance plan.); Active military service and summer encampment. All forms of payments from Individual Retirement Programs,

such as Keogh, Tax Shelter Annuity, IRA, and 401K are not deductible.

LINE 2: ALLOWABLE EMPLOYEE BUSINESS EXPENSES

DOCUMENTATION REQUIRED: Pennsylvania forms UE-1, UE-2 or Federal form 2106 must be enclosed (photocopies are accepted).

Outside Salesperson: Overnight lodging, mileage, and other necessary business expenses are allowed as a deduction, if not reimbursed by employer.

Travel while away from home overnight including expenses incurred when an individual is away from home "overnight". "Overnight" is a time period

substantially longer than an ordinary day's work that requires a relief from duty to obtain sleep or rest away from home, including but not limited to air, rail,

and bus fares; operation and maintenance of an automobile, taxi fares or other transportation, such as trips between airport or station and hotel, from one

place of business to another, or from where you eat and sleep to temporary work assignment; meals and lodging when away from home on business; and

tips that are incidental to any of the above expenses.

Transportation: Allowable transportation costs are the costs of traveling from one place to another if directly attributable to the conduct of employment. They

must be incurred while the employee is not in a travel status. Commuting to and from work are not allowable transportation costs.

Education: Allowable education expenses must meet the express requirements of the employer or laws or regulations for keeping a job or position. Tuition,

books, supplies, laboratory fees and similar items and certain related travel and transportation costs may be excluded from income.

Other Expenses: Other allowable expenses include but are not limited to union dues and initiation fees; professional dues and subscriptions to professional

journals; small tools and supplies; uniforms (not suitable for everyday) and protective clothing required by an employer.

Office Rental or Office-in-Home: An exclusion for an office-in-home may be taken if the following requirements are met: a suitable work space is not

provided by the employer; the activity of work is such that it requires a work area for its performance or for the storage of goods and wares on the premises

other than that of the employer; a letter is submitted on employer's letterhead stating in detail why office is necessary in order to work for the employer.

The letter must be signed by an officer or owner of the company. Expenses which are not allowable include but are not limited to, commuting to and

from work, child care and moving.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2