Form Dvat 16a - Return To Be Furnished By A Casual Trader - Delhi Department Of Trade And Taxes

ADVERTISEMENT

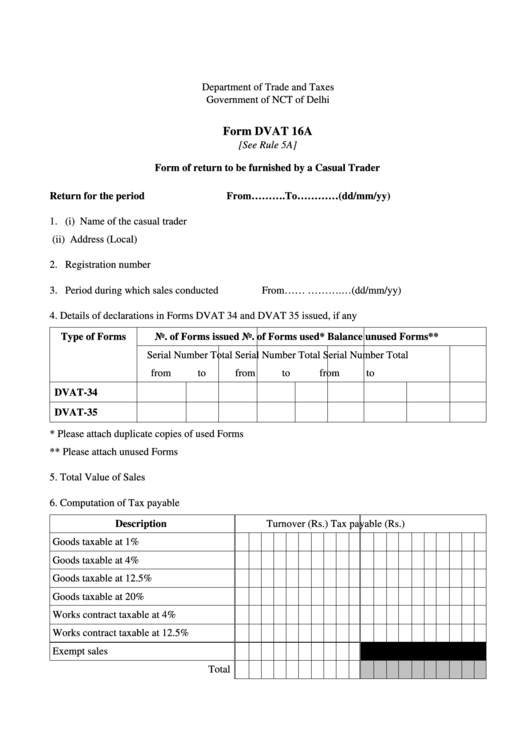

Department of Trade and Taxes

Government of NCT of Delhi

Form DVAT 16A

[See Rule 5A]

Form of return to be furnished by a Casual Trader

Return for the period

From……….To…………(dd/mm/yy)

1. (i)

Name of the casual trader

(ii) Address (Local)

2. Registration number

3. Period during which sales conducted

From……...To……….…(dd/mm/yy)

4. Details of declarations in Forms DVAT 34 and DVAT 35 issued, if any

Type of Forms

No. of Forms issued

No. of Forms used*

Balance unused Forms**

Serial Number

Total

Serial Number

Total

Serial Number

Total

from

to

from

to

from

to

DVAT-34

DVAT-35

* Please attach duplicate copies of used Forms

** Please attach unused Forms

5. Total Value of Sales

6. Computation of Tax payable

Description

Turnover (Rs.)

Tax payable (Rs.)

Goods taxable at 1%

Goods taxable at 4%

Goods taxable at 12.5%

Goods taxable at 20%

Works contract taxable at 4%

Works contract taxable at 12.5%

Exempt sales

Total

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2