Form Dvat 16a - Return To Be Furnished By A Casual Trader - Delhi Department Of Trade And Taxes Page 2

ADVERTISEMENT

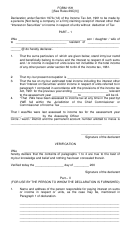

7. Tax Payable

:

___________________

8. Add : Interest, if payable

:

___________________

9. Add : Penalty, if payable

:

___________________

10. Less : Tax Deducted at Source (TDS)

(Attach original TDS Certificates)

:

___________________

11. Less : Tax paid

:

___________________

12. Balance payable/refundable (7+8+9-10-11)

:

___________________

13. Details of payment of tax (attach proof of payment)

S. No.

Date of deposit

Challan No.

Name of Bank and Branch

Amount

14. Verification

I/We _______________ hereby solemnly affirm and declare that the information given in this form

and its attachments (if any) is true and correct to the best of my/our knowledge and belief and nothing

has been concealed therefrom.

Signature of authorised signatory

______________________________________

Name

______________________________________

Designation/Status

______________________________________

Place

______________________________________

Date

___ ___ / ___ ___ / ___ ___ ___ ___

dd

/

mm

/

yyyy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2