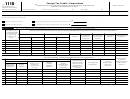

3

Form 1120-W (WORKSHEET) 2001

Page

(a)

(b)

(c)

(d)

First 4

First 6

First 9

Entire year

months

months

months

20

Add lines 17 through 19.

20

21

Divide line 20 by 3.

21

22

Divide line 15 by line 21.

22

23

Figure the tax on the amount on line 22 by following the same

steps used to figure the tax for line 16, page 1 of Form 1120-W.

23

24

Divide the amount in columns (a) through (c) on line 16a by

the amount in column (d) on line 16a.

24

25

Divide the amount in columns (a) through (c) on line 16b by

the amount in column (d) on line 16b.

25

26

Divide the amount in columns (a) through (c) on line 16c by

the amount in column (d) on line 16c.

26

27

Add lines 24 through 26.

27

28

Divide line 27 by 3.

28

29

Multiply the amount in columns (a) through (c) of line 23 by

the amount in the corresponding column of line 28. In

column (d), enter the amount from line 23, column (d).

29

30

Enter other taxes for each payment period (see instructions).

30

31

Total tax. Add lines 29 and 30.

31

32

For each period, enter the same type of credits as allowed on

lines 17 and 21, page 1 of Form 1120-W (see instructions).

32

33

Total tax after credits. Subtract line 32 from line 31. If zero

or less, enter -0-.

33

34

Add the amounts in all preceding columns of line 41 (see

instructions).

34

35

Adjusted seasonal installments. Subtract line 34 from line

33. If zero or less, enter -0-.

35

Part III—Required Installments

1st

2nd

3rd

4th

installment

installment

installment

installment

36

If only one of the above parts is completed, enter the amount

in each column from line 13 or line 35. If both parts are

completed, enter the smaller of the amounts in each column

from line 13 or line 35.

36

37

Divide line 23b, page 1 of Form 1120-W, by 4, and enter

the result in each column. (Note: “Large corporations,” see

the instructions for line 25 on page 5 for the amount to enter.)

37

38

Enter the amount from line 40 for the preceding column.

38

39

Add lines 37 and 38.

39

40

If line 39 is more than line 36, subtract line 36 from line 39.

Otherwise, enter -0-.

40

41

Required installments. Enter the smaller of line 36 or line

39 here and on line 25, page 1 of Form 1120-W.

41

1120-W

Form

(2001)

1

1 2

2 3

3 4

4 5

5 6

6