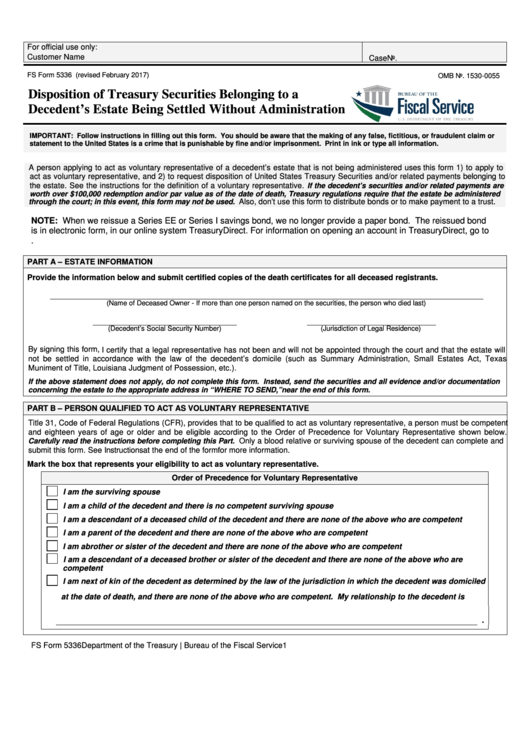

RESET

For official use only:

Customer Name

Case No.

FS Form 5336 (revised February 2017)

OMB No. 1530-0055

Disposition of Treasury Securities Belonging to a

Decedent’s Estate Being Settled Without Administration

IMPORTANT: Follow instructions in filling out this form. You should be aware that the making of any false, fictitious, or fraudulent claim or

statement to the United States is a crime that is punishable by fine and/or imprisonment. Print in ink or type all information.

A person applying to act as voluntary representative of a decedent’s estate that is not being administered uses this form 1) to apply to

act as voluntary representative, and 2) to request disposition of United States Treasury Securities and/or related payments belonging to

the estate. See the instructions for the definition of a voluntary representative.

If the decedent’s securities and/or related payments are

worth over $100,000 redemption and/or par value as of the date of death, Treasury regulations require that the estate be administered

Also, don’t use this form to distribute bonds or to make payment to a trust.

through the court; in this event, this form may not be used.

NOTE: When we reissue a Series EE or Series I savings bond, we no longer provide a paper bond. The reissued bond

is in electronic form, in our online system TreasuryDirect. For information on opening an account in TreasuryDirect, go to

PART A – ESTATE INFORMATION

Provide the information below and submit certified copies of the death certificates for all deceased registrants.

(Name of Deceased Owner - If more than one person named on the securities, the person who died last)

(Decedent’s Social Security Number)

(Jurisdiction of Legal Residence)

By signing this form, I certify that a legal representative has not been and will not be appointed through the court and that the estate will

not be settled in accordance with the law of the decedent’s domicile (such as Summary Administration, Small Estates Act, Texas

Muniment of Title, Louisiana Judgment of Possession, etc.).

If the above statement does not apply, do not complete this form. Instead, send the securities and all evidence and/or documentation

concerning the estate to the appropriate address in “WHERE TO SEND,” near the end of this form.

PART B – PERSON QUALIFIED TO ACT AS VOLUNTARY REPRESENTATIVE

Title 31, Code of Federal Regulations (CFR), provides that to be qualified to act as voluntary representative, a person must be competent

and eighteen years of age or older and be eligible according to the Order of Precedence for Voluntary Representative shown below.

Carefully read the instructions before completing this Part.

Only a blood relative or surviving spouse of the decedent can complete and

submit this form. See Instructions at the end of the form for more information.

Mark the box that represents your eligibility to act as voluntary representative.

Order of Precedence for Voluntary Representative

I am the surviving spouse

I am a child of the decedent and there is no competent surviving spouse

I am a descendant of a deceased child of the decedent and there are none of the above who are competent

I am a parent of the decedent and there are none of the above who are competent

I am a brother or sister of the decedent and there are none of the above who are competent

I am a descendant of a deceased brother or sister of the decedent and there are none of the above who are

competent

I am next of kin of the decedent as determined by the law of the jurisdiction in which the decedent was domiciled

at the date of death, and there are none of the above who are competent. My relationship to the decedent is

.

FS Form 5336

Department of the Treasury | Bureau of the Fiscal Service

1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10