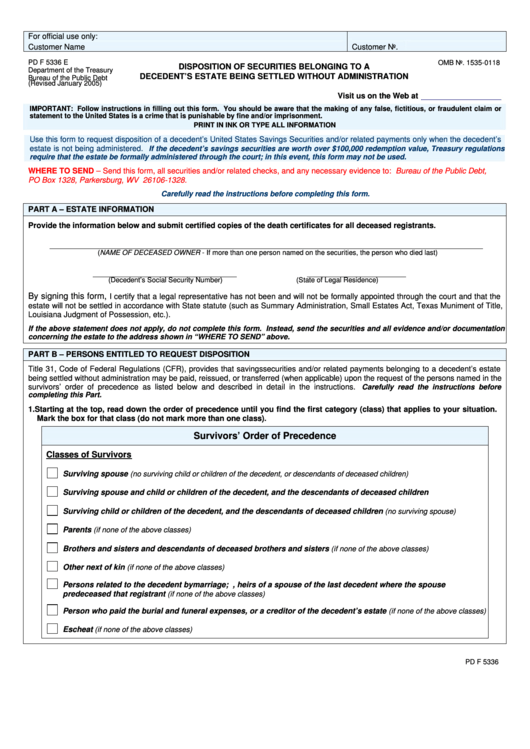

For official use only:

Customer Name

Customer No.

PD F 5336 E

OMB No. 1535-0118

DISPOSITION OF SECURITIES BELONGING TO A

Department of the Treasury

DECEDENT’S ESTATE BEING SETTLED WITHOUT ADMINISTRATION

Bureau of the Public Debt

(Revised January 2005)

Visit us on the Web at

IMPORTANT: Follow instructions in filling out this form. You should be aware that the making of any false, fictitious, or fraudulent claim or

statement to the United States is a crime that is punishable by fine and/or imprisonment.

PRINT IN INK OR TYPE ALL INFORMATION

Use this form to request disposition of a decedent’s United States Savings Securities and/or related payments only when the decedent’s

estate is not being administered.

If the decedent’s savings securities are worth over $100,000 redemption value, Treasury regulations

require that the estate be formally administered through the court; in this event, this form may not be used.

WHERE TO SEND – Send this form, all securities and/or related checks, and any necessary evidence to: Bureau of the Public Debt,

PO Box 1328, Parkersburg, WV 26106-1328.

Carefully read the instructions before completing this form.

PART A – ESTATE INFORMATION

Provide the information below and submit certified copies of the death certificates for all deceased registrants.

(NAME OF DECEASED OWNER - If more than one person named on the securities, the person who died last)

(Decedent’s Social Security Number)

(State of Legal Residence)

By signing this form,

I certify that a legal representative has not been and will not be formally appointed through the court and that the

estate will not be settled in accordance with State statute (such as Summary Administration, Small Estates Act, Texas Muniment of Title,

Louisiana Judgment of Possession, etc.).

If the above statement does not apply, do not complete this form. Instead, send the securities and all evidence and/or documentation

concerning the estate to the address shown in “WHERE TO SEND” above.

PART B – PERSONS ENTITLED TO REQUEST DISPOSITION

Title 31, Code of Federal Regulations (CFR), provides that savings securities and/or related payments belonging to a decedent’s estate

being settled without administration may be paid, reissued, or transferred (when applicable) upon the request of the persons named in the

survivors’ order of precedence as listed below and described in detail in the instructions.

Carefully read the instructions before

completing this Part.

1. Starting at the top, read down the order of precedence until you find the first category (class) that applies to your situation.

Mark the box for that class (do not mark more than one class).

Survivors’ Order of Precedence

Classes of Survivors

Surviving spouse

(no surviving child or children of the decedent, or descendants of deceased children)

Surviving spouse and child or children of the decedent, and the descendants of deceased children

Surviving child or children of the decedent, and the descendants of deceased children

(no surviving spouse)

Parents

(if none of the above classes)

Brothers and sisters and descendants of deceased brothers and sisters

(if none of the above classes)

Other next of kin

(if none of the above classes)

Persons related to the decedent by marriage; i.e., heirs of a spouse of the last decedent where the spouse

predeceased that registrant

(if none of the above classes)

Person who paid the burial and funeral expenses, or a creditor of the decedent’s estate

(if none of the above classes)

Escheat

(if none of the above classes)

PD F 5336

RESET

1

1 2

2 3

3 4

4 5

5 6

6 7

7