Application for Extension of Time to File City Income Tax Partnership Return

Important Information

Line-by-Line Instructions

An extension of time to file is not an extension of time to

Partnership Name and Address: The address entered here is

pay. The form and payment must be postmarked on or before

the address that will be used for correspondence regarding this

the original due date of the return.

extension request.

Tax Year Ending: Enter the month and year your tax year ends,

City Income Tax Partnership filers must use this form to

NOT the date you are making the payment.

request an extension and must file it even if the Internal

Revenue Service has approved a federal extension and/or the

Federal Employer Identification Number (FEIN): Use the

Michigan Department of Treasury has approved a state tax

FEIN used when filing the City of Detroit Partnership Income Tax

extension.

Quarterly Estimated Payment Voucher (Form 5461). This is the

FEIN that should be used when filing the City of Detroit Income Tax

Do not send a copy of the federal extension or state extension.

Partnership Return (Form 5458).

Retain a copy for your records.

Submitting an Extension

An extension of time to file is not an extension of time to pay.

If there will be a tax liability, payment must be included with

Make the check payable to “State of Michigan - Detroit.” Write

this form and/or appropriate estimated tax payments (of at least

the Federal Employer Identification Number (FEIN) and “2017

70% of the prior year tax obligation) must have been made

Form 5460” on the check. Complete Form 5460 and mail, with

during the tax year, or the extension request will be denied. If

the payment, to:

the tax due is underestimated and the payment made with the

Michigan Department of Treasury

extension request is insufficient, interest and penalty are due on

City Tax Administration

the amount underpaid.

PO Box 30813

If this form is properly prepared, meeting all listed conditions,

Lansing MI 48909

and filed timely, the taxpayer will receive an extension of six

months beyond the original due date.

Reset Form

#

Detach here and mail with your payment.

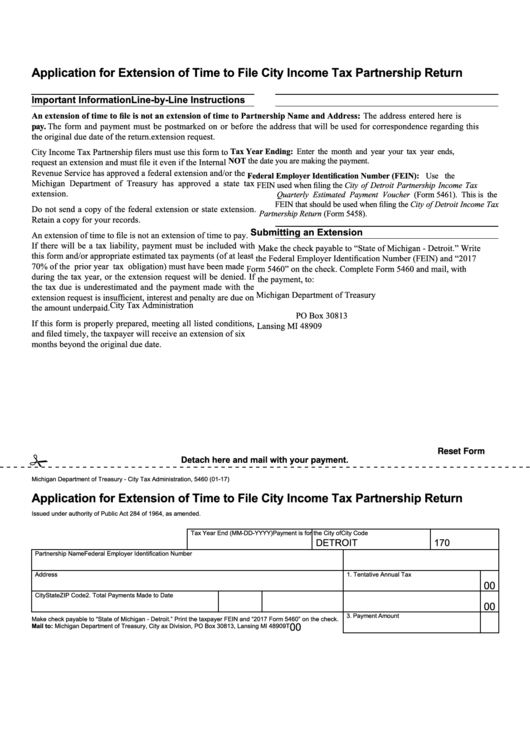

Michigan Department of Treasury - City Tax Administration, 5460 (01-17)

Application for Extension of Time to File City Income Tax Partnership Return

Issued under authority of Public Act 284 of 1964, as amended.

Tax Year End (MM-DD-YYYY)

Payment is for the City of

City Code

DETROIT

170

Partnership Name

Federal Employer Identification Number

Address

1. Tentative Annual Tax

00

City

State

ZIP Code

2. Total Payments Made to Date

00

3. Payment Amount

Make check payable to “State of Michigan - Detroit.” Print the taxpayer FEIN and “2017 Form 5460” on the check.

00

Mail to: Michigan Department of Treasury, City ax Division, PO Box 30813, Lansing MI 48909

T

1

1